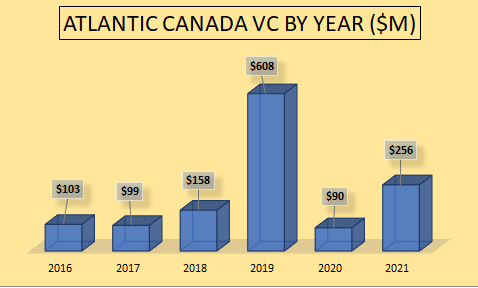

Though missing out on the bonanza of mega-deals, Atlantic Canada recorded one of its best years ever last year in raising venture capital, according to the Canadian Venture Capital & Private Equity Association.

The CVCA released its 2021 data report on Tuesday, showing that Atlantic Canadian startups raised $256 million in 55 deals. Almost half the money was raised in New Brunswick, which benefited from the biggest East Coast deal of the year – Introhive’s US$100 million (C$122 million) round in June.

That round was the only Atlantic Canadian mega-deal (a round of more than $50 million) in the CVCA tally. There were 71 such deals in Canada last year, driving the country’s VC industry to a record-breaking $14.2 billion invested across 751 deals. That was more than twice the previous record of $6.2 billion across 539 deals in 2019, said the CVCA.

“2021 was another record year for VC investment driven by larger cheques into maturing Canadian companies,” said CVCA Chief Executive Kim Furlong in a statement. “Our seed-stage companies saw a substantial increase in deal volume. This is a strong signal that the pipeline of next growth companies is being seeded.”

In Atlantic Canada, the CVCA data shows 2021 was the strongest year of investment ever with the exception of 2019, when the region reported growth capital of $608 million. New Brunswick and Newfoundland reported strong funding last year, while the CVCA numbers were weaker than usual in Nova Scotia and P.E.I. (The Association reported two deals in P.E.I., though their total value was less than $1 million.)

Provincial Breakdown of Annual VC Funding

| NS | NB | NL | PEI | Total | |

| 2021 | $53M | $126M | $77M | n/a | $256M |

| 2020 | $65M | $10M | $9 | $6M | $90M |

| 2019 | $67M | $16M | $524M | $1M | $608M |

| 2018 | $67M | $78M | $5M | $8M | $158M |

| 2017 | $77M | $16M | $6M | $0 | $99M |

| 2016 | $64M | $32M | $7M | $0 | $103M |

Source: CVCA

The case could be made that the funding in 2021 will have a broader impact than that of 2019. In the earlier year, two deals accounted for more than nine-tenths of the money raised – Verafin’s $515 million equity-and-debt round, and ABK Biomedical’s US$30 million raise.

Though Introhive’s deal dominated the 2021 funding data, it was not the only major round. The strong funding in Newfoundland and Labrador was led by CoLab Software’s US$17 million (C$21 million) Series A funding round and Mysa Smart Thermostat’s $20.3 million round. (Even if we exclude these two companies, Newfoundland startups raised about $36 million, which would constitute a strong year of fundraising.)

Other eight-figure deals included Fredericton’s Smart Skin Technologies closing a $10.7 million round of funding and Dartmouth-based Outcast Foods raising $10 million.

The funding in the region may even be better than the CVCA figures indicate as some companies with dual headquarters in Atlantic Canada and the U.S. are not included in the CVCA databank. For example, it appears the association did not include Sonrai Security’s US$50 million (C$61.9 million) round. The CVCA doesn’t name specific deals in its report so it’s not known if it included encryption startup Cape Privacy, a New York company with a base in Halifax. It raised US$20 million.

The CVCA for the first time reported on the jobs supported by the VC raises – not new jobs created, but employment at companies that raised venture capital. These companies employ more than 1,000 people in Atlantic Canada – 365 in New Brunswick, 359 in Newfoundland and Labrador, 282 in Nova Scotia and 23 in Prince Edward Island.

Furlong added the momentum is energizing but there is more work to be done, saying: “It’s important to note that Canada’s VC market is still emerging and is 4.5 times smaller than the US. There’s still significant room for growth.”