The Atlantic Canadian startup community in 2020 eked out its weakest growth in at least seven years as the pandemic resulted in fewer new companies and more failures.

This is the preliminary picture of the East Coast startup community that we’ve drawn from the 2020 Entrevestor Databank. Given the uncertainty created by the pandemic, we’re releasing preliminary data as quickly as we can this year. The numbers may change before we put out the final report in June, but it gives a general picture of how the community grew in 2020.

We’ll get a more complete picture of the revenue, funding and job creation in the community as we receive more completed surveys. Policy-makers and support organizations rely on this data, so if you’re the founder of an innovation-driven startup, please take a few minutes to fill in the survey.

Here are the findings so far:

Total Number of Companies 720

Year-on-Year Growth 3.3%

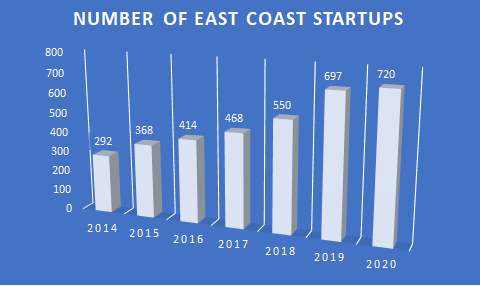

This is the biggest community of innovation-driven startups we’ve seen in Atlantic Canada, but the community also experienced its slowest growth since we began collecting data seven years ago. In 2019, the number of companies had spiked 27 percent to 697 – a breakout year given that we had seen consistent 15 percent growth in the four previous years. Though the growth was slow in 2020, the quality of companies likely improved as interesting new companies came in and weaker startups fell by the wayside.

Number of New Companies in 2020 88

Number of New Companies in 2019 164

It should be no surprise there were fewer rookie startups in 2020 than the previous year, as several university campuses were empty, taking away one source of new founders. The 46 percent drop is larger than we would have expected. We’re still learning of new companies and hopefully we’ll find more before the final report. As was usually the case, IT accounted for the vast majority of the new companies, and about 15 percent of the rookies were in the ocean space. As has been the case for the past few years, there were a lot of new startups in St. John’s.

Failures in 2020 100

Failures in 2019 47

The data on failures has been the most interesting part of the exercise so far. When discussing the impact of the pandemic on startups last year, I often heard that there was no sign of a wave of companies going under. But when we began to go through the databank company by company, we found that a lot of them had gone – in fact, 100 on the nose. It wasn’t that the pandemic had wiped out a lot of companies that would have otherwise thrived. A year earlier, we had classified most of these companies as zombies or companies just starting out. Only five of the 100 had raised capital.

One interesting facet of this segment of the study is that many founders shut down their companies and moved on immediately to better opportunities. Patrick Hankinson, the Founder of Concrete Ventures, has noted recently that employment at Atlantic Canadian high-growth companies increased 7 percent in 2020, with 40 percent of the companies in the community increasing staff. Searching LinkedIn, you find many young people who were trying to start a company a few years ago, and have jumped to attractive positions with scaling or established innovation-driven companies. The sector is healthy and demand for good people is strong.

One final note: If there were more failures than new ventures, why did the overall number of companies rise? Two reasons. First, there are always companies that work quietly for a year or two before revealing themselves, and we’re now identifying some of those. And second, a lot of established companies moved into the region from elsewhere in the last year. More than we’ve ever seen before.

We’ll post more insights from our databank as we continue to get more material. Meanwhile, please keep those surveys coming in.