In his most recent tally of employment by Atlantic Canadian innovators, Patrick Hankinson of Concrete Ventures has concluded that the region’s high-growth companies have continued to add staff through the pandemic.

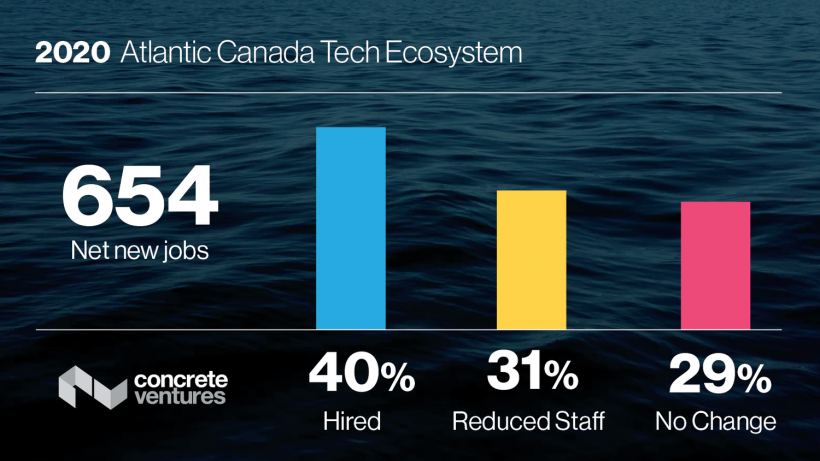

He posted a blog last week that the startup community in Atlantic Canada produced a net 654 new jobs in 2020, bringing the total to 10,337 jobs – an increase of almost 7 percent. Of the companies that he’s tracking, 40 percent added staff, 29 percent had no change and 31 percent shed employees.

In a blog on his site, Hankinson said he had been pessimistic about the outlook for startups when the pandemic broke out last spring. But the more optimistic entrepreneurs at the time were proven correct as many of the region’s startups continued to grow through the pandemic – especially in Newfoundland and Labrador.

“In terms of employment growth, five of the 14 top companies were from Newfoundland and Labrador, and if you move past those 14, there were other Newfoundland companies that are showing some strength,” said Hankinson in an interview. “It’s pretty clear to say that Newfoundland is punching above its weight.”

Though Hankinson’s main job is early-stage investment in Atlantic Canadian startups, he’s also methodical in collecting and analyzing data on startups. He has his own databank of Atlantic Canadian startups, and assesses their staffing levels based on LinkedIn.

Like we do with the Entrevestor Databank, Hankinson judges startups not to be just new companies but enterprises based in Atlantic Canada that are developing an innovative product for the global market. The Concrete list of companies includes ventures that have exited but retained operations in the region, like Charlottetown’s BioVectra. Entrevestor removes exited companies from its databank. That is the main reason that Entrevestor said the total number of jobs in the region was about 6,500 at the end of 2019 (our most recent data), whereas Hankinson placed it closer to 9,700.

See Also: TrojAI is the latest portfolio company in Concrete Ventures.

Hankinson admits there are limits to tabulating employment based on LinkedIn data, because not all people use LinkedIn or update their employment status regularly. But he adds that it is useful in assessing the direction of the job market as it shows whether employers are adding or shedding employees.

The leader in adding jobs last year was St. John’s-based Verafin, which was growing before it agreed to be taken over by Nasdaq for US$2.8 billion in September and has continued to grow since then.

The other companies that have been adding employees strongly are: BioVectra, Charlottetown; LuminUltra Technologies, Fredericton; Genoa Design, St. John’s; Mariner Partners, Saint John; CarbonCure Technologies, Dartmouth; VidCruiter, Moncton; Proposify, Halifax; Dash Hudson, Halifax; Mysa Smart Thermostats, St. John’s; The Rounds, Halifax; Sonrai Security, Fredericton; CoLab Software, St. John’s; and Celtx, St. John’s.

Hankinson ended his blog with a reminder that not all sectors of the economy have been as fortunate as the IT and life sciences sectors. He encouraged successful companies to keep hiring.

“If you happen to be an entrepreneur who had a good 2020 and is planning on a good 2021, I would implore you to consider taking a chance on that recent graduate who has shown you a lot of grit, or that unemployed individual who could be a great employee if you just invested in the development of their professional skills,” he wrote.

“If we all did that, our industry would have a blowout year compared to previous years, and who knows, it could even make a dent in those unemployment numbers.”