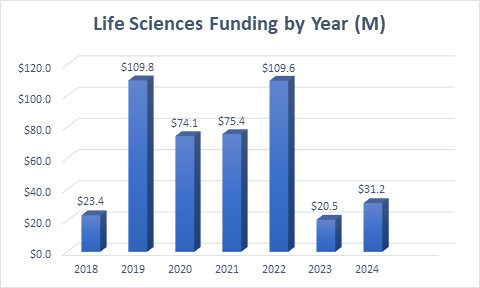

Atlantic Canada’s life sciences and medtech sectors demonstrated resilience in 2024 with notable revenue growth, though equity funding for life sciences companies has fallen in recent years.

Today we’re highlighting the section of our 2024 Atlantic Canada Startup Data Report that looked at these two inter-related sectors. In our databank, we track 146 life sciences companies, which include a range of biology-based enterprises. We also track 88 medtech companies, most of which make digital products for the medical community. There is, of course, some overlap and 47 companies are members of both sectors.

Life sciences companies raised a total of $31.2 million in 2024 after a weak showing the previous year, and the total for both years remains depressed by historical standards. From 2019 to 2022, funding in the life sciences sector averaged $92.3 million, and was never below $74 million.

The loss of major publicly listed companies such as IMV and Appili Therapeutics in recent years has clearly dampened funding volumes. Still, some impressive private raises highlighted the sector’s potential in 2024.

Sparrow BioAcoustics, a St. John’s-based medtech firm behind the Stethophone, led the way with a $10 million tranche in a $13 million seed round. Halifax’s Sperri, which produces plant-based meal replacements, secured over $4 million in a round led by Nàdarra Ventures. Meanwhile, Dieppe-based Triple Hair raised $4 million to advance its treatment for genetic hair loss.

The life sciences sector posted a surprising 68.6 percent increase in revenue last year, more than triple the growth reported by the region’s IT startups. This spike is particularly notable given the sector’s lengthy regulatory timelines and product development cycles. Entrevestor's data shows 146 active life sciences companies in the region, including 18 newcomers, employing 1,427 people—a 6.5 percent rise in employment.

While some of the companies reporting strong growth work with natural substances and are not strictly involved in traditional medical product development, the scale of the revenue boost signals a broader market traction. That said, the sector has continued to struggle with public market fundraising since key players like Appili Therapeutics and IMV—both publicly listed drug discovery firms—shuttered or restructured. As a result, public equity funding in 2024 dropped to just $1.6 million, all of it raised by Sona Nanotech. This marks a sharp decline from the $54.7 million raised through stock markets as recently as 2020.

Looking ahead, 2025 is already off to a promising start. In January, Halifax-based SoundBlade, which has developed an ultrasound-powered tissue-cutting tool, raised US$16.5 million (C$23.8 million) in a Series A round, generating significant buzz in the sector.

Entrevestor began tracking medtech—a sub-sector focused on digital products for healthcare—a few years ago. The category now includes 88 companies employing 778.5 people. Though the job count grew 10.3 percent year-over-year, the number of active companies actually declined slightly, from 89 in 2023 to 88 in 2024, with only nine new entrants compared to 15 the previous year.

Still, medtech outpaced life sciences in job growth, and its revenue rose by 14.4 percent. It also stands out for its leadership diversity: 39 percent of medtech companies are led by women, tying life sciences for the highest proportion of female leadership among Atlantic Canadian startups.

Sparrow BioAcoustics’ $10 million raise was a highlight here as well, underscoring the growing intersection of medtech and life sciences. Many medtech companies also appear in the IT or advanced manufacturing sectors, showing the increasingly interdisciplinary nature of innovation in this space.

Perhaps the most promising sign for both sectors is the emergence of scaleups. Ten of Entrevestor’s 25 identified Scaling Companies in Atlantic Canada—defined as startups with proven traction and growing revenues—are life sciences or medtech firms. This 40 percent share demonstrates that a significant portion of the region’s most promising startups are solving healthcare challenges.