Halifax-based Metamaterial Technologies Inc. has purchased a British medical technologies company that brings it into the realm of healthcare for the first time.

MTI said in a statement today it has bought London-based Medical Wireless Sensing Ltd., known as Mediwise, for an undisclosed sum.

What the two companies have in common is they both produce metamaterials, which are man-made materials with synthetic nanostructures, usually created to carry out a commercial task. Whereas MTI until now has worked with metamaterials that alter light, Mediwise has pioneered products used in healthcare, especially those used for non-invasive diagnoses.

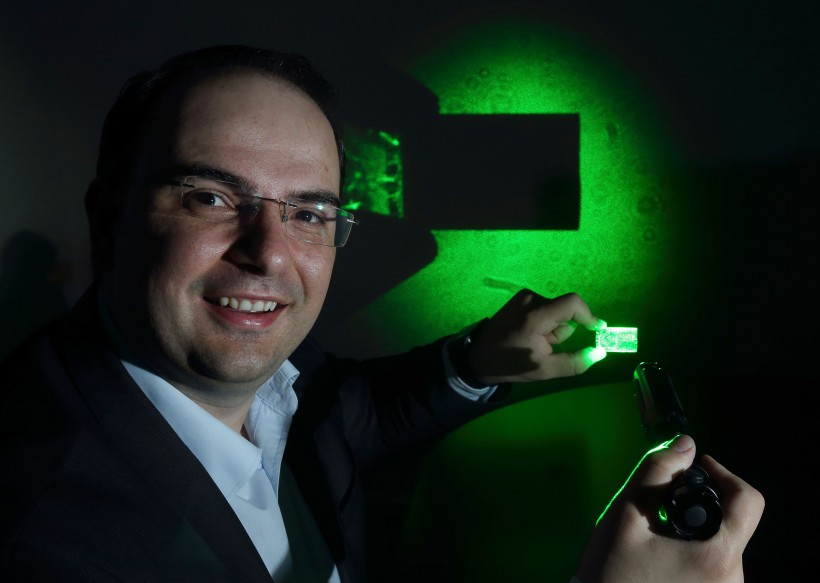

“Mediwise technology has the potential to allow users to non-invasively access specific information about their health and their body, faster and more accurately through the science of metamaterials,” said MTI Founder and Chief Executive George Palikaras in a statement. “This is a strategic market-extension offering complementary advanced materials technology, intellectual property and new business opportunities for MTI.”

Mediwise was formed in 2010 by a group of British scientists, including Palikaras, who was studying in London. In an interview this morning, he said the Mediwise technology includes film that can be placed on the skin and let users see deeper into the tissue than current products. This can result in cleaner images and quicker MRIs, which could improve efficiency at hospitals, said Palikaras.

The British company’s portfolio of 22 patents includes the IP for a product called Glucowise. It has the potential to safely detect the concentration of glucose in the blood stream without having to draw blood or use test strips.

In 2014, the British company earned first place at the Massachusetts Institute of Technology’s Building Global Innovators competition for the health stream and was the overall winner. Mediwise’s partners include Queen Mary University and King’s College in London and the Leiden University Medical Centre in the Netherlands.

Terrapure Buys Canadian Operations of Envirosystems

Palikaras said Mediwise has conducted pre-clinical and clinical tests on its technology. MTI hopes its own involvement will help accelerate the efforts to get through the regulatory process and bring a Mediwise product to market.

“We do have experience in regulatory processes in that we’ve gone through it with an aerospace product,” he said. “Our solution to it is essentially to do it with a very large partner . . . so we plan to partner with an OEM [original equipment manufacturer].”

Until now, MTI has focused on metamaterials that can filter, absorb or reflect light. Its first commercial project was MetaAir, a see-through screen that filters out laser attacks on aircraft. MTI and European aircraft maker Airbus are working together on this product. Last summer, MTI signed a $5.6 million agreement with aerospace giant Lockheed Martin to develop materials that enhance solar power and can be used on aircraft.

MTI will take on six engineers with the purchase of Mediwise, bringing its global headcount to 40. Palikaras also said the company is now working on an equity funding round worth about US$10 million, which he hopes to complete this year.

The company has raised a total of $15 million in equity investment in its history, including an $8.3 million funding round led by Radar Capital of Toronto last year. The company last year also received a $5.4 million grant from Sustainable Development Technology Canada for its solar product.

Mediwise is the second acquisition in MTI’s seven-year history. In May 2016, MTI bought the business of Silicon Valley peer Rolith to accelerate the development of its manufacturing facility, also for an undisclosed amount. That acquisition gave the company a base in California and helped it produce its light-filtering product in larger sheets in commercial quantities.

Earlier this month, MTI announced the appointment of three new board members: career investment banker Doug Hall, who becomes the Chair; private equity executive Bill Lambert; and management consultant Eric Leslie.