The year 2016 was a tremendous year for the funding of startups in Atlantic Canada – maybe the best ever.

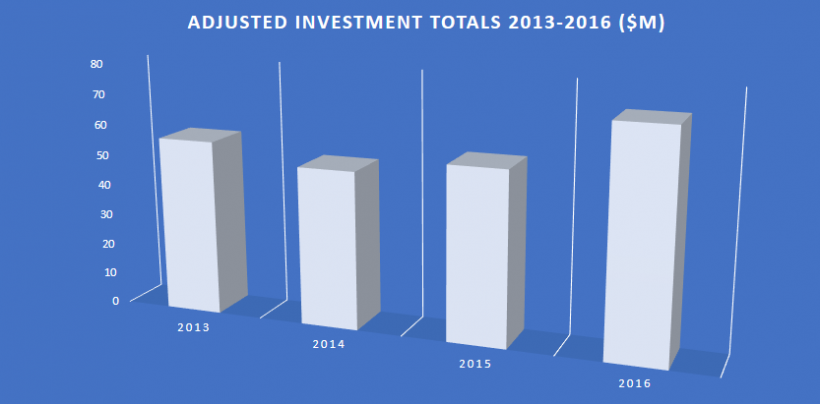

According to data collected by Entrevestor, Atlantic Canadian startups raised $73.3 million in 2016 from venture capital, strategic and angel investors. That’s up by about one-third from $55.5 million in 2015.

And the great thing was that the deals came in a broad range of shapes and sizes – a few investors (note the plural) from Silicon Valley, investments by super angels, and a swath of funding by local institutions.

Each year, Entrevestor collects and analyzes data on the startup community across Atlantic Canada, and equity funding is one of the closely studied portions of the study. Startup entrepreneurs and their supporters love funding data as it’s considered – rightly or wrongly – a barometer for the health of the startup community. And the data from 2016 suggest the East Coast community is healthy indeed.

What was exceptional about 2016 was that there were so many companies bringing in $3 million in funding, especially from outside the region.

“The recent participation of ‘super angels’ like John Risley in the local start-up scene, along with deeper funding commitments by well-capitalized VCs like Build Ventures, have contributed to the increasing average deal size,” said Gregg Phipps, Managing Director of Investment at Innovacorp. “It’s a positive development, for certain.”

The main reason for the higher funding levels is a handful of large deals, led by three deals worth more than $8 million each. Halifax’s TruLeaf Sustainable Agriculture announced an $8.5 million equity financing from a group of angels. Kinduct Technologies of Halifax raised US$9 million, led by Intel Capital. And Fredericton-based Resson raised US$11 million in a funding round led by Monsanto Growth Ventures. They headed a list of 16 companies in the region that announced they raised C$1 million or more in 2016.

Entrevestor counted a total of 47 equity funding deals in 2016, of which 29 were worth less than $1 million. These smaller deals are vitally important. While founders in the rest of the country complain about a lack of seed funding, the Atlantic region is a hotbed of seed funding. According to data collected by Canada’s Private Equity and Venture Capital Association, Atlantic Canada accounted for 10 percent of the VC deals in the country, though it had no deals in the top 10 in terms of value.

Patrick Keefe of Build Ventures also explains that seed rounds are essential to the ecosystem because the follow-on funding rounds are impossible without the small rounds. He said there tends to be a 30 percent attrition rate between rounds of funding. So, if 10 companies raise a seed round, only seven will survive to raise an A round. And of those, about five will be able to raise a B round, and so on. The A rounds financed by Build and the groups from outside the region can only happen if there is a broad range of seed rounds.

In all, Entrevestor counted 55 companies that received funding in 2016. That means more than 13 percent of the startups in the region received some funding last year. The main reason for the number of deals is the continued activity of the government-backed funds. In all, 35 companies in 2016 received money from these organizations (including Build Ventures).