Atlantic Canadian startups raised about $25 million in venture capital in the second quarter of 2025, says Canada’s main VC body, largely because of an undisclosed deal in Newfoundland and Labrador.

The Canadian Venture Capital and Private Equity Association, known as CVCA, on Wednesday released its VC data for the first half of the calendar year. It showed the four eastern provinces amassed a total of $61 million in VC funding in the January-June period. We subtracted the $36 million reported in the first quarter to come up with the second-quarter total of $25 million.

The report shows there was a single funding round reported in Newfoundland and Labrador last quarter, and it was worth $20 million. The CVCA released no information about the target of the investment other than that it was an ICT company. It’s obviously a stealth round as there was no public announcement of such a big round in recent months.

The other provincial totals for the second-quarter were: one deal worth $3 million in Nova Scotia; three deals worth $2 million in New Brunswick and no VC rounds in Prince Edward Island.

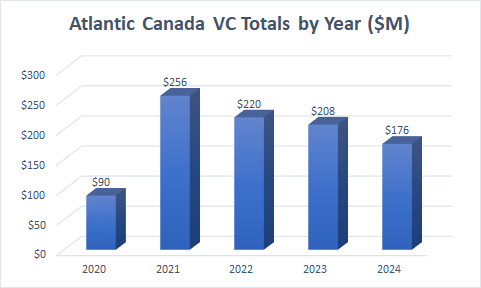

The numbers overall are disappointing. First, the region as of Canada Day was on track to raise $122 million for 2025. That would be the lowest VC total since the $90 million mark in 2020. According to the CVCA data, Atlantic Canadian VC funding peaked for the first five years of this decade in 2021 at $256 million, and has declined each year since, hitting $176 million in 2024.

Annual VC totals in Atlantic Canada, according to the CVCA

There have been a few bright spots on the funding front in the second half of 2025. Halifax-based Mara Renewables raised US$9.1 million (C$12.6 million) from S2G Investments in July. And in the public markets, St. John’s-based Kraken Robotics closed a $115 million funding exercise on the TSX Venture Exchange, hitting the top of a range it outlined in June.

The second disappointment is how few companies are receiving venture capital. According to the CVCA data, only five companies received venture capital in the second quarter. The problem created by so few companies receiving VC dollars is compounded by the weak angel funding the region has experienced in the past few years.

The CVCA report also mentioned a couple of Atlantic Canadian funding bodies. Invest Nova Scotia was named among the most active “government funds” as it was involved in two deals worth a total of $27 million. It participated in funding rounds by Halifax companies Sound Blade Medical and 3DBioFibr. Also, the New Brunswick Innovation Foundation was named among the most active investors in pre-seed rounds, investing in two such rounds.

For Canada overall, startups raised a total of $2.9 billion in the first half across 254 deals, marking the lowest first-half total since 2020, said the CVCA. It was a 26 percent decline in dollars invested compared with the previous first half.

Information technology dominated the league tables in terms of sectors, accounting for $1.4 billion in first-half VC funding or 48 percent of the national total. It was the most active sector in eight provinces, and Nova Scotia was the only province that did not have a single IT venture capital deal in the first half.

“We are seeing more selective deployment of capital, especially at the critical earliest stages of investment,” said David Kornacki, Director of Data and Product at CVCA. “What stands out is the continued strength in life sciences, a rise in large venture debt transactions and the utilization of secondaries to provide liquidation for early investors. These shifts point to evolving investment strategies across a maturing ecosystem.”