One part of our Atlantic Canada Startup Data report that merits closer examination is our claim that the region has a problem with early-stage funding.

This sort of funding declined in 2019 for the first time in three years, and the pandemic will likely result in a further drop in 2020. And that is important because funding rounds of less than $500,000 are needed to bring young companies to the position at which they can scale.

The recent good news in the startup community has come from established companies like Kinduct, CarbonCure and Metamaterial Inc. But younger companies need to get that initial funding round under their belts in order to grow into the larger, more successful corporations. And a smaller proportion of young companies are raising funding rounds than in previous years.

To recap: Atlantic Canadian funding in 2019 was record-setting because of the record $515 million debt-and-equity round recorded by St. John’s based-fintech company Verafin. But if we strip out the Verafin deal, the region’s startups raised less capital last year than the year before.

That suggested there was a problem in funding for early-stage companies, so we dug into our databank to look at two metrics that could shed light on the subject.

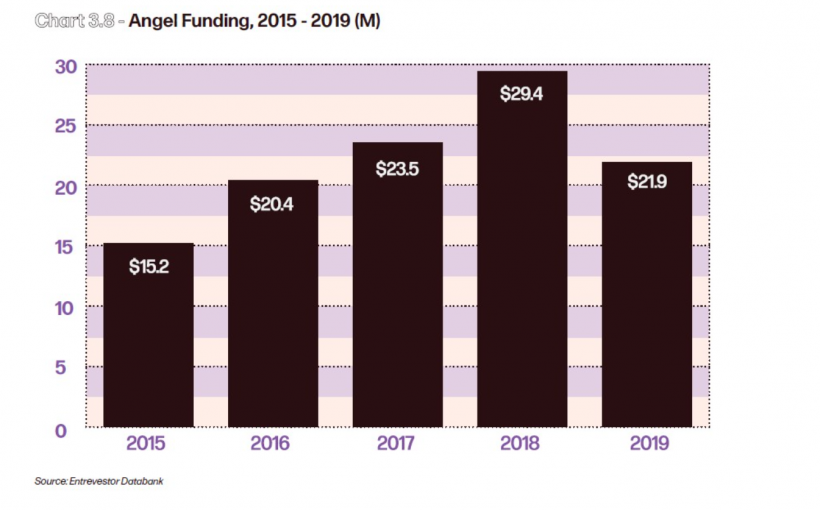

First, we looked at angel funding – that is, equity investments from wealthy individuals.

Though Entrevestor previously disputed the view that angel funding was declining in the region, the 2019 data (and the subsequent recession) should sound alarm bells.

Atlantic Canada recorded $21.9 million in angel investment in 2019 – a drop of more than 25 percent from 2018 and the weakest figure in three years. What’s most concerning is that angel funding levels may fall again in 2020, at a time when many startups need funding to weather the recession.

But angel funding isn’t the same as “early-stage” financing. We’ve seen plenty of bona fide Series A funding rounds that have come entirely from angels, because a wealthy individual can have as much investment capacity as a VC fund.

So we looked at a second metric from the past two years: funding rounds of $20,000 to $500,000, or the type typically raised by early-stage companies.

| Funding Rounds of $20K-$500K | 2018 | 2019 |

| Number of Companies Raising $20K-$500K | 64 | 56 |

| Percentage of Startup Community | 12% | 8% |

| Total Raise | $11.8M | $9.5M |

Once again, we see that there was a decline in absolute terms. Only 56 companies raised this sort of round in 2019, for a total of $9.5 million, compared with 64 companies for $11.8 million the previous year.

As Senator Colin Deacon pointed out in an interview, the overall community grew in that time, so the amount of early-stage funding should also have risen. (The number of startups in the community rose 23 percent to 697 companies in 2019.)

That means that 12 percent of the total Atlantic Canadian community raised an early-stage round in 2018, but a year later that portion had fallen to 8 percent.

That’s a worrying trend. Companies need capital now to see them through the coming Winter of Discontent and into the recovery that is expected late next year.