Sponsored Content

Kevin Sullivan likes to reflect on how much the Nova Scotian life sciences sector has grown since he moved to Halifax to head a biotech company in 2013.

In those days, Nova Scotia’s bio sector had aspirations and enthusiasm, but few companies had products in the market, and no company had rewarded investors. It was a matter of potential for success rather than evidence of success.

“In late 2013, there was nothing going on here really,” said Sullivan, a serial bio-entrepreneur who is now the Co-Founder and CEO of 3D BioFibr. “It was really, really slim pickings. At that time, it was IT [information technology] that was kind of the darling sector. It feels like that flipped in some ways and life sciences has kind of outperformed.”

How true. In the tortoise-and-hare race between biological and digital entrepreneurs, the folks in white lab coats are no longer runners up. There is a solid core of elite companies, a few of them publicly listed. Funding in the space has grown exponentially in the last three years. And there is an exciting crop of young companies that are attracting both interest and investment.

The bio sector had already gained momentum in 2018 and 2019, then in 2020 the global pandemic hit and several Atlantic Canadian companies – especially publicly listed ones – took off. It wasn’t just Atlantic Canada. There has been a global celebration of the fact that human ingenuity produced effective vaccines against a deadly pandemic in just a year, and that celebration is channelling more money and resources into life science industries, in Canada and elsewhere.

“There are millions of conversations going on right now,” said Scott Moffitt, Executive Director of BioNova, the association overseeing the life sciences sector in Nova Scotia “As part of the national biotech accord, which is driven by BIOTECanada . . . we put in a request to the Prime Minister to have a national life sciences strategy, to have a bit more focus on the sector from a national level. COVID-19 is a terrible thing, but it really has shone a bright light on this sector and seriously justified additional support for this sector at all levels of government.”

Supporting NS through the Pandemic

The impact of COVID-19 was felt immediately in the Nova Scotian life sciences segment, though it affected different companies in different ways. In some cases, it forged new partnerships as groups like engineering firm Enginuity, advance knee-brace manufacturer Spring Loaded Technology and others came together to manufacture desperately needed personal protection equipment, or PPE. BioNova provided the partners with advice on how to gain medical approval and budgeted more than $200,000 to support the initiative.

“Companies were able to pivot and really protect our healthcare system by manufacturing PPE, and it showed our willingness to get involved,” said Moffitt. “We saw that with companies like Spring Loaded and MacKenzie Atlantic. If that hadn’t happened then Nova Scotia healthcare would have been in a real pickle.”

For the life sciences sector itself, the most notable impact of the pandemic was the increased valuations for larger companies, and how that allowed them to raise more money. This was especially apparent in the large, publicly listed companies based in Halifax. Appili Therapeutics, which commercializes drugs to treat infectious diseases, raised $27.2 million by selling shares, and IMV, whose flagship drug candidate provides a platform to deliver drugs to fight cancer and infectious diseases, raised $25.2 million. And Sona Nanotech, which was trying to develop its gold nanorod technology into a rapid test for COVID-19, raised $2.3 million.

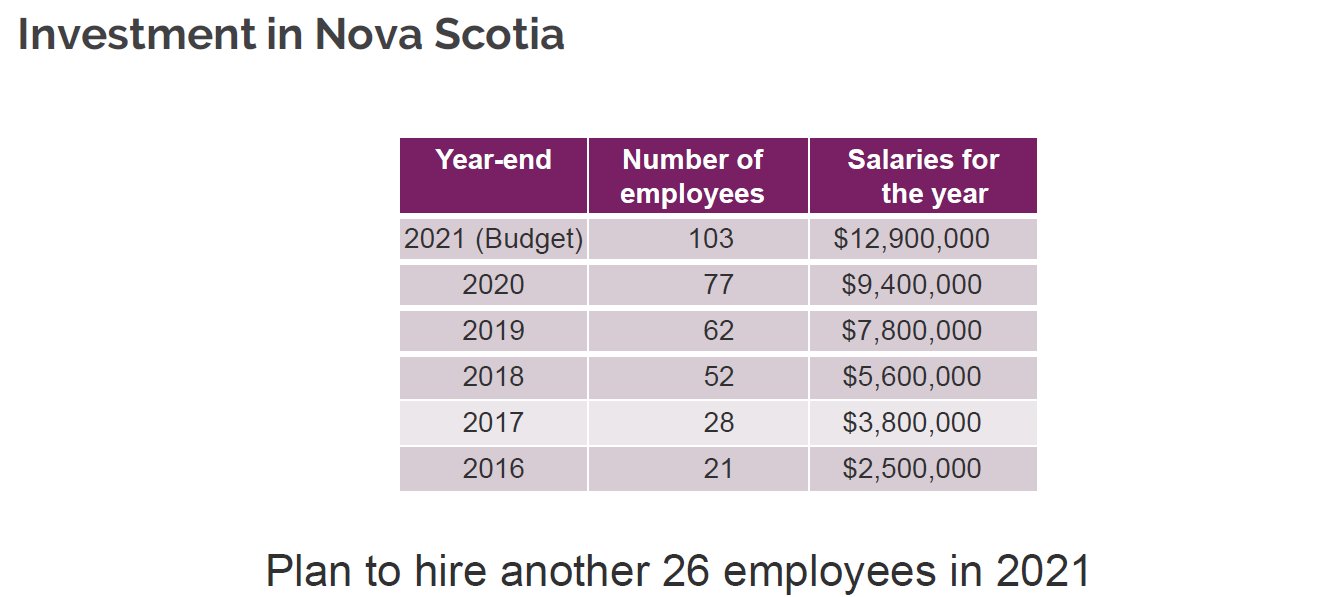

These companies are reinvesting this money in their Nova Scotia operations to develop medical products. IMV, for example, is working toward two separate Phase 2B trials for its flagship drug candidate, Maveropepimut-S (DPX-Survivac), to assess its effectiveness in combatting difficult-to-treat cancers. Because of this, it plans to increase its staff by about one-third this year, and spend almost $13 million on research and development. Since 2016, IMV has spent $42 million on salaries in Nova Scotia alone, as shown in the following chart:

The sector is also benefiting from other large companies that aren’t listed on stock exchanges. For example, Charlottetown-based drug manufacturer BioVectra, which is owned by American private equity group H.I.G. Capital, has invested over $100 million into the capital equipment and site capability in Windsor, NS, since 2014.

More than 100 people are now working at the Windsor facility, and more than 60 percent of them have come from other parts of Canada or other countries. These specialized employees are involved in research, process development, technical transfer and manufacturing of biologic drug substances.

Data compiled by Entrevestor.com, shows the strong growth experienced last year by the 91 Nova Scotian life sciences companies it tracks. These companies raised a total of $58.4 million in capital, up from $23.8 million in 2017. In 2020, their staffing levels rose about 18 percent from 2019 to 1,269 employees. This doesn’t include some companies that have exited, such as Biovectra and its 100 Nova Scotian employees. What’s more, the sector is a strong employer of women and minorities. The staff of IMV, for example, is more than half female.

A Wave of Younger Companies

While the large companies have captured the headlines, there is a wave of smaller companies that are growing rapidly. Through the Health Challenge Pitch Event, local companies like Adaptiiv and WeUsThem have seen their products used by the Nova Scotia Health Authority. Densitas has had its software adapted by health authorities in all three Maritime Provinces. Coloursmith Labs, which is developing contact lenses that can filter out harmful rays or correct colour blindness, is continuing to grow and recently closed a $2 million funding round. In 2020, 27 percent of health and life sciences companies in Atlantic Canada were led by women, which was twice as high as other sectors. The life sciences sector features several young female founders and CEOs such as Coloursmith’s Gabrielle Masone, DeNova’s Brianna Stratton and Motryx’s Franziska Broell.

One of the most recent entrants is 3D BioFibr, which launched last year when Sullivan teamed up with Dalhousie University researcher John Frampton, who has improved methods of producing biofibres. These are fibres that exist in nature and are used by humans, such as spider silk, collagen, and chitosan. Frampton’s methods allow them to be produced in industrial quantities at lower prices than are currently available, and the company is preparing to launch its first product, using manmade collagen to build 3D tissue culture.

Sullivan perceives a definite gain in momentum in the Nova Scotia biotech community, and says bio-entrepreneurs are taking advantage of the “structural advantages” they enjoy in the provinces. Dalhousie University, he said, is driving biomedical innovation in the region, and hospitals are becoming more involved in entrepreneurship. Atlantic Canadian entrepreneurs also have greater access to non-dilutive funding than their counterparts in other parts of the country, thanks to the accessibility of programs from the Atlantic Canada Opportunities Agency and National Research Council IRAP. The growth of the Creative Destruction Lab-Atlantic is also helping develop the space, he said.

“I was involved last year with CDL as a mentor and this year as a mentee,” said Sullivan, adding that 3D BioFibr recently graduated from the program. “CDL is bringing in high net worth individuals locally [to act as investors] but we also engaged with fantastic mentors throughout North America through CDL. We found it really valuable in getting connected with people in the industry.”

The Next Phase of Growth

The entrepreneurs and their support organizations say now is not the time for Nova Scotia’s life sciences sector to rest on its laurels but to plot and execute on the next phase of growth. BioNova is preparing for the next phase, and laid out its vision in BioFuture 2030. Penned in 2018, the report plots a course for the Nova Scotia bio community to double the number of health and life sciences companies to 200, almost triple the number of employees to 4,200, and almost quadruple annual sales to $1.1 billion. The kernel of the plan is a roadmap to increase the number of life sciences ventures in the province, to bring their products to market faster, and help them to scale more successfully.

“We’ve been changing BioNova in the past few years,” said Moffitt. “We’ve been trying to accelerate companies, and all of our programming reflects that these days. The things we’re doing now [include] building coaching and mentorship groups specifically for med devices, bringing in top executives from Canadian medtech companies.”

He said BioNova is now on track to meet the ambitious goals of BioFuture 2030, and the plan has been backed by such groups as the Atlantic Canada Opportunities Agency and others. Now BioNova wants anyone interested in developing the life sciences sector in Nova Scotia to work with them on achieving the plan’s goals. The BioNova team says it has the deepest knowledge of the sector, is talking constantly to entrepreneurs in the space, and can coordinate the growth of the sector.

“We’d like to see more people get on board with the plan so things aren’t just happening in silos,” said Shana Cristoferi, the Marketing Manager at BioNova. “Sometimes there’s an overlap in planning, and we want everyone to have the same focus on the sector.”

The growth of the industry will require more mentorship and programming, but also an investment in infrastructure particular to the life sciences. For example, cities like Charlottetown and Montreal have “bio-parks” that feature such facilities as wet labs, but Halifax lacks such a resource.

“There’s not enough physical lab space,” said Coloursmith Labs CEO Gabrielle Masone, a big fan of the ecosystem who believes the infrastructure could be better. “If Nova Scotia wants to grow its technology sector, there are some resources it needs and one of them is lab space.”

“It was a bit of an awe-inspiring journey, and at the end of the day we probably had one of the most successful years on record during the pandemic,” said Moffitt. “That’s laying a great groundwork so that as we enter recovery mode . . . there’s an opportunity for the provincial government to get on board. When you look at the amount of revenue being generated, I think it would be a good idea for the provincial government to get behind it even more.”

About BioNova

BioNova leads, accelerates, and advocates for Nova Scotia’s growing health and life sciences sector. Since 1993, BioNova has been accelerating the growth of its member companies and offers funding and resources based on present day needs in the industry. While these companies commercialize life-changing research to improve healthcare, provide healthier food, and develop clean energy solutions, BioNova advocates on behalf of the sector.

Bioport Atlantic

BioNova will host its 20th annual BioPort Atlantic conference Nov. 2-5, at which participants will discuss the evolution of the life sciences sector. For more information and to purchase tickets, click here.