After two years of bootstrapping, Talem Health Analytics of Sydney is eyeing a paid pilot project early in the new year that would bring in revenue and hopefully pave the way to investment.

Founded two years ago by physiotherapists Paul Travis and Matthew Kay, Talem has developed software that can help auto insurers understand the time and costs of an individual recovering from a car accident. Drawing on data from physiotherapy clinics, the software uses machine learning and data analysis to predict how someone who has been in an accident will recover.

“We’re collecting information from the medical profession to essentially treat clients better and reduce the economic impact [of auto accidents],” said Travis in an interview.

The company has now grown to a five-member team – no mean feat considering it has not raised significant equity financing nor drawn revenue from clients. What this young fintech company has done is brought on a two-member programing team with experience in machine learning, data analytics and the insurance industry.

Insurers currently have difficulty assessing the recovery path for people injured in auto accidents. The Talem product uses machine learning to analyze data on injuries and tell insurers how a person with a specific injury or injuries will rehabilitate, how long it might take and what the risks are.

The Talem development team has been able to come up with a product that will be ready for the pilots in the first quarter of 2019.

Marcato Sold to Patron, which Plans Sydney Expansion

Travis said the company is now in discussions with two auto insurers based in the U.S. and that it hopes to have them signed up for pilots soon. Talem has also been in talks with potential investors, which could come aboard once the pilots are arranged. Kay and Travis are hoping to close an initial funding round of about $750,000 by the end of February.

So far, they have funded the company mainly from competitions and grants, including the National Research Council’s Irap program.

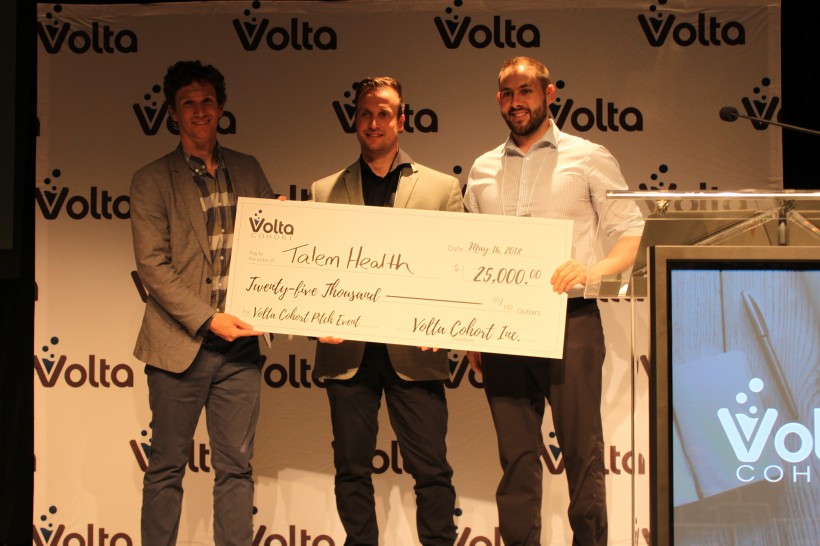

A winner of $50,000 in Innovacorp’s Spark competition, Talem was one of the five winners that took home $25,000 at the last Volta Cohort in May. Now it is a semi-finalist for the BioInnovation Challenge, the region’s top life sciences pitching competition, which will take place next month. The winner of the competition will also receive $25,000 in funding to develop their business idea as well as a package of support services and mentoring valued at more than $30,000.

The plan is for the company to go through a three-month pilot early next year, then later in the year the founders hope for a full launch for the product. The goal is for the insurers that go through the pilot to sign up as full customers, and for Talem to sell the product to other auto insurers as well.

Once it has bona fide traction in the auto sector, Talem hopes to expand its client base into the industrial insurance segment. Travis said it would be a natural expansion for the fintech company and would not require a lot of new functionality in the platform.