Since April, there’s been a post-it on the window frame beside my desk that has only a number and a word written on it. It reads: “486 companies”.

Actually, when I first stuck it up, it read “485 companies”, but I had to add one so I took a black marker and changed the 5 to a 6.

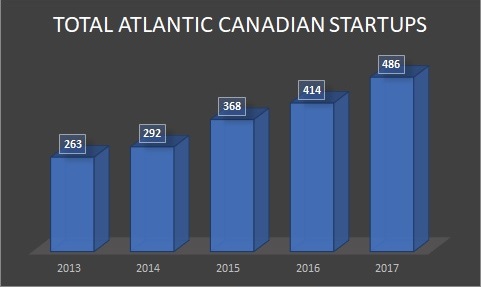

The number 486 became really important to me because it was the number of Atlantic Canadian startups I had identified as being in business as of Dec. 31, 2017. That number was the bedrock of Entrevestor’s Atlantic Canadian Startup Community 2017 report, our annual study of the region’s innovation group.

For the past five years, Entrevestor has managed a databank of Atlantic Canadian startups – which we define as locally owned companies that are commercializing innovation to produce a product for the global market. We survey these companies and analyze the data in one big report (it runs to 60 pages this year). By selling that report to clients, we’re able to continue to provide free news on the startup community.

The first step of doing the report each year is to figure out how many of these high-growth companies are active. It’s important because most of the stats – like the percentage of companies in one sector or province – are based on the total number of companies.

Getting to that total is no mean feat. First, new companies are being created all the time. Second, some “companies” are really just projects in university entrepreneurship courses and disappear once the course ends. I try to make sure I only include teams who are committed to their projects.

CarbonCure Grows in San Francisco Area

Then I have to toss out companies from the previous year that have shut down. Again, it’s a tough task. Founders don’t call up a journalist to say they’ve gone out of business. Most startups don’t close down on a certain date – more often, entrepreneurs put them on ice and they fade away. It’s hard to find a pulse with some companies, though their founders aren’t ready to ship them to the morgue yet.

The total number of companies keeps changing throughout the exercise as I learn of births and deaths. All these grey areas meant the final figure could have been anywhere between 470 and 500, but 486 was my best estimate.

What’s important is how that headline number has grown in the past five years. When we started this exercise five years ago, Entrevestor was tracking 263 companies. That’s compounded annual growth of almost 17 percent.

There’s no sign that the growth is slowing down. In fact, what we noticed in 2017 was an acceleration in both the creation of new companies and the failure of weak companies. We counted 114 new companies last year and 66 failures – both were records for us, and both are healthy developments.

It’s obvious we need new startups to keep momentum growing and further build up the community. The increase in failures is healthy because it shows entrepreneurs are ready to abandon experiments that don’t work, freeing up human resources for other, more successful companies.

I expect the total number of companies will be well over the 500 mark by the end of 2018. The growth in mentorship programs is leading to stronger company formation. Some will thrive. Most won’t. But the community will continue to grow.