Atlantic Canadian startups raised $57 million in venture capital through 13 deals in the first quarter – a respectable performance given the decline in venture capital elsewhere in the county.

Canada’s Venture Capital and Private Equity Association, or CVCA, released its first quarter data report on Thursday, showing that Canadian startups raised $1.3 billion in the first quarter. It was a drop of 72 percent from the first quarter of 2021, and only the second time since the beginning of 2021 that the quarterly figure had fallen below $2.5 billion.

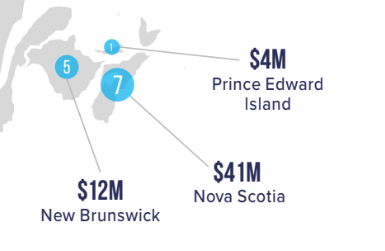

The Atlantic Canada numbers were led by Nova Scotia, which logged seven deals worth $41 million. It was followed by five deals worth $12 million in New Brunswick and a single $4 million raise on Prince Edward Island. The CVCA recorded no funding rounds in Newfoundland and Labrador.

“In Atlantic Canada, VC investments remained consistent with 2022 numbers, with Nova Scotia receiving the highest investment in the region,” said the report. “These investments demonstrate growing strength in investable companies in the region.”

Related Article: Atlantic Canadian Startup Jobs Fell in Q1.

The CVCA report noted that agtech or agribusiness attracted a lot of capital, both across Canada and on the East Coast. In Atlantic Canada, eight of the funding deals were by IT startups, and the second most active sector was agribusiness.

“For investors, there is money to be made investing with purpose in agtech.” Peter Goggin, Director of Investments at the New Brunswick Innovation Foundation, said in the report. “At NBIF, we have an active and growing agtech portfolio, with common themes hovering around data-driven insights, actionable analytics, novel systems and solutions.”

The largest funding round we’ve reported on at Entrevestor so far in 2023 was the $10.2 million raise by Halifax’s Graphite Innovation & Technology, which was announced in early April and likely included in the first quarter data. There were also seven-figure deals reported between January and March by NovaResp, and The Rounds, both of which are based in Halifax.

Though the CVCA recorded no first-quarter deals in Newfoundland and Labrador, there was a $2.7 million funding round closed by medtech company SiftMed. The company's team is spread across several jurisdictions but Entrevestor classifies it as being based in St. John's.

The $57 million headline figure for the first quarter puts the region on track to bring in $228 million in venture capital this year, which would pretty well match the $230 million the CVCA recorded last year. It shold be remembered that last year’s tally and the $256 million in funding seen in 2020 were two of the best years for VC funding that Atlantic Canada has ever seen.

The association in recent reports has also been logging venture debt, which it defines as “short-to-medium term, non-dilutive debt instrument with no equity rider.” Nova Scotia recorded a loan worth about $400,000 in this category and New Brunswick had one worth less than $100,000.

On a national level, the tone of the CVCA report was upbeat, with CEO Kim Furlong noting that venture capital funding in Canada basically returned to pre-pandemic levels

“In Q1, we observed VC investors prioritizing higher quality companies and adopting a cautious approach,” she said in the report. “These strategies are in response to current market conditions, where investors are staying the course, keeping companies private until values and private markets have rebounded.”