The federal government is preparing to cover 75 percent of the wages of qualifying small and medium-sized businesses for three months, as well as extending these companies interest-free loans.

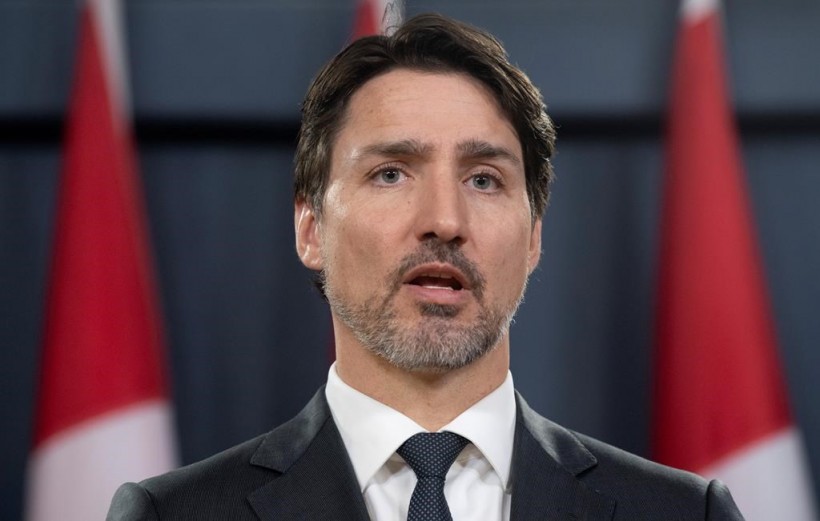

Prime Minister Justin Trudeau announced the measures at his Friday press conference in Ottawa, saying his government had decided to improve on a previous pledge to provide 10 percent of SMEs’ wages during the Covid-19 crisis.

“It’s becoming clear that we need to do more — much more — so we’re bringing that percentage up to 75 per cent for qualifying businesses,” said Trudeau. “This means people will continue to be paid even though their employers have to slow down or stop their businesses.”

Before Friday, the federal government had reacted to the Covid-19-induced economic shock with a $107 billion stimulus package. But there was concern that SMEs were still vulnerable because in many cases their revenues had ceased but they still had fixed and staffing costs.

The government is now encouraging them to retain or hire back their staff by covering 75 percent of payroll for “qualifying businesses”. The money will be available for up to three months, back-dated to March 15.

More details – including details on what constitutes a qualifying company – are due to be released this week.

“The Government is finally hearing the concerns from the business frontlines by bringing forward wage subsides, and we urge them to continue to find ways to appropriately support Canada's entrepreneurs during this difficult time,” said the Canadian Council of Innovators in a series of tweets.

“The government’s decision to inject short-term liquidity to our SMEs through government-backed loans is critical for Canada’s long-term economic recovery, because expanded wage subsidies alone, while necessary and welcome, aren’t enough to keep Canadian companies afloat.”

Trudeau also said the government would create a new $25 billion program to help financial institutions extend loans to SMEs that will be interest-free for the first 12 months. Called the Canada Emergency Business Account, the program will provide loans guaranteed by the Canadian government to ensure that small businesses have access to the capital over the next few months.

These loans of as much as $40,000 will be available for businesses with payrolls of less than $1 million, and $10,000 of the loans may be forgivable for some qualifying businesses.

Trudeau said that on top of that, the government will provide $12.5 billion through Export Development Canada and Business Development Bank to help SMEs meet their operational cash flow requirements.

Through the federally owned BDC, businesses can apply for term loans of up to $6.25 million, with 80 percent of each loan provided by BDC with the remainder coming from a private financial institution. Eligible financial institutions will conduct the underwriting and funding directly for customers.

EDC will provide guarantees to financial institutions, allowing them to issue operating credit and cash flow loans of up to $6.25 million. EDC will guarantee 80 percent of the loans, which are expected to be repaid within a year.

Finally, SMEs and self-employed people are being allowed to defer all goods and services tax or harmonized sales tax payments due March 31 until June, as well as customs duties owed for imports. The government said in a statement this measure is the equivalent of providing up to $30 billion in interest-free loans to Canadian businesses.

“Small businesses are the backbone of our economy, and an important source of good jobs across this country,” said Trudeau. “They are facing economic hardship and uncertainty during the Covid-19 pandemic, and that is why we are taking action now to help them get the financial help they need to protect their workers and pay their bills.”