We’re super proud today to publish our first Canadian Oceantech Data Report, which we hope will provide a baseline for analyzing ocean-related innovation in Canada in coming years.

This is the first time we’ve produced a national research report rather than a regional one, and we view this report very much as a pilot project. This document is part of our expansion into the oceantech coverage beyond Atlantic Canada, which we hope will culminate in the launch of a stand-alone news site late in the year.

The report – which aims to produce a snapshot of the sector as of year-end 2021 – is free for anyone to download. Just click here to go to the landing page for the report, and leave your email address to download it. We’re leaving this landing page on our site so you can download the report at any time.

When we say that this is a pilot project, we also want to emphasize that there is room for improvement in subsequent reports. Entrevestor is based in Atlantic Canada, and we tried to prevent Atlantic Canadian biases from creeping into the text, and to analyze the activity in other parts of the country, especially British Columbia.

This report is the result of about six months of research, during which time we compiled a databank of 304 companies that are active in oceantech in Canada. These include companies that are development offices of ventures based in other countries, and large manufacturers or consultancies. This total includes 187 oceantech startups, which are the group we analyzed most closely.

We’d like to thank two people who made this report possible: Don Grant, Executive Director of the Ocean Startup Project, was essential in coming up with the idea and developing the databank; and Mike Cyr at Charcoal Marketing helped us immeasurably in publishing the report.

You can find our executive summary on Page 3 of the report, but here are the highlights:

An oceantech community is not just a startup group near a wharf

The greatest challenge we faced in analyzing this community is understanding how different the “oceantech community” is from a conventional startup community. We’re used to an innovation centre being a gaggle of locally owned startups within a jurisdiction. The oceantech community is very different. First, there are manufacturers, consultancies and non-profits whose contributions can’t be ignored. Impact is important in a startup community, but much more important in the oceantech world because the health of the oceans and their inhabitants is paramount. And finally, international companies with operations in Canada play a huge role – and not just big multi-nationals but startups like Ireland’s Xocean or Norway’s Resqunit.

Established companies in the West; startups in the East

The hallmark of the Canadian oceantech community right now is that the West Coast is home to established companies, especially manufacturers, while startups are proliferating on the East Coast. We classify 50 of the companies in our databank as manufacturers and 22 of them are based in B.C. Meanwhile, of the 187 startups we identified, 54 of them are in Nova Scotia and 23 in Newfoundland and Labrador. We should add, however, the startups in B.C. appear to be the most advanced in the country. The average age of B.C. startups is just over four years, compared with 3.5 years elsewhere in Canada. B.C. startups have an average of 6.8 employees compared with 4.3 in the other provinces.

This sector is growing quickly

Of the 304 companies in our databank, 70 were formed in 2021. Some of these were simply idea-stage ventures that will likely never get off the ground. But the ecosystem is producing a wave of new oceantech ventures that we haven’t seen before. The outlook for the growth of more companies is encouraging.

Funding is improving

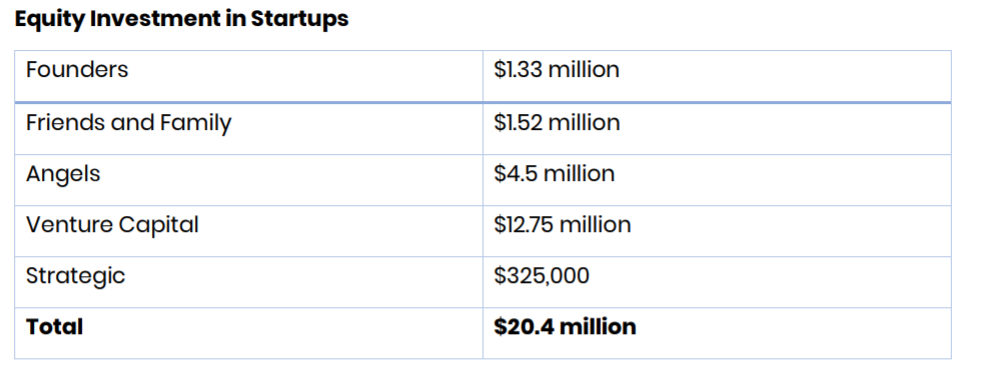

In researching Atlantic Canadian startups over the past few years, we’ve been struck by the fact that non-dilutive financing has always been stronger than equity investment. With this current exercise, we’re noticing an improvement in equity funding -- $20.4 million in equity funding in 2021 for Canadian oceantech startups. Of that total, $12 million went to Atlantic Canadian startups – a roughly sixfold increase over the $2.1 million raised by Atlantic Canadian oceantech startups in 2020. The largest single funding round was a $5.5 million raise by Sherbrooke, Que.-based Oneka Technologies, which is developing wave-powered desalination technology.

Female entrepreneurs are active in this sector

We found that about 23 percent of the startups responding to our survey had at least one female founder, or their CEO was female. That’s a better representation than the 14 percent we found in the Atlantic Canadian startup community in 2020. The eight female-led companies that completed our survey employed 43 people and collectively raised $5.1 million in equity funding.

The oceantech community is engaged in First Nations economies

The oceantech community includes Indigenous founders, and features many partnerships between oceans companies and Indigenous communities. Of the 304 companies in our databank, seven have Indigenous founders, representing just over 2 percent. Though it’s admittedly a small percentage, it’s roughly twice the proportion we’ve seen for the overall startup community in Atlantic Canada. The companies range from Acoustic Bait of Antigonish, NS, which sends sounds through water to attract lobster; to Waspu of Qalipu First Nation, NL, which is producing Omega-3 from seal oil. The oceantech movement also offers plenty of opportunities for non-Indigenous entrepreneurs to partner with First Nation bands to the benefit of both parties. Canada’s Ocean Supercluster has established an Indigenous Working Group to work toward great representation by First Nations people in the oceans economy and the Ocean Startup Project is hiring an Indigenous Coordinator based in British Columbia to support new ocean entrepreneurial ideas.

The Atlantic Canadian ecosystem has international stature

One thing that we find astonishing is how quickly Atlantic Canada has developed an oceantech ecosystem that has gained international attention. Most of the components of the ecosystem, such as COVE, Canada’s Ocean Supercluster, CDL-Oceans, and the Ocean Startup Project did not exist five years ago. They are not only generating companies within the region but attracting companies from other parts of the world. This is an asset that benefits the whole country, while many of these organizations are working at extending the ecosystem across Canada.