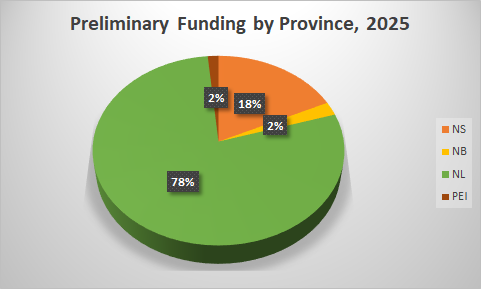

When we finally tally all the Atlantic Canadian startup funding for 2025, we’re going to end up with two major groups: A. Newfoundland and Labrador, and B. everyone else.

While that’s not a surprise to anyone who’s been paying attention this year, what is surprising is that Group A. will likely be almost four times as large as Group B.

With a few weeks left to go in the year, innovation-driven companies based on The Rock account for almost four-fifths of equity funding booked this year. The main reason is the huge funding rounds by four St. John’s companies: Kraken Robotics, Colab Software, Spellbook, and Sparrow BioAcoustics.

In deals announced so far this year, Newfoundland and Labrador companies have raised $295.5 million, while those based in the Maritimes have secured $82.2 million. That means NL accounts for about 78 percent of this year’s announced deals as of Dec. 8. What’s more, Newfoundland and Labrador companies also accounted for more than half the funding in the region in 2024.

Sparrow’s recent announcement that it closed a $10 million funding round was somewhat overshadowed by the other NL raises. (We admit it: we missed the Sparrow round altogether.) But this young medtech company is one of the region’s biggest magnets for investment, with this round coming just a year after it finished a $13 million, multi-tranche funding exercise.

"This round ensures we can scale responsibly through this critical phase, supporting hospitals and patients with the same focus on quality and outcomes that brought us here," said Sparrow CEO Mark Opauszky in the announcement. "It's about maintaining the momentum we've built while continuing to deliver real clinical value where it's needed most."

When we gather funding data at Entrevestor, we include any innovation-driven company based in Atlantic Canada as long as they’re producing a product for global distribution. We look for funding from any one of six sources: founders; friends and family; angels; venture capital; strategic partners; and stock markets. Most of the data that we’ve collected so far has come from major deals; we’ll learn more about the smaller deals and stealth rounds as founders complete our 10-question survey.

The funding news this year has been dominated by the four big rounds in Newfoundland:

Kraken Robotics

In July, the maker of next-generation sonar systems closed a $115 million, oversubscribed sale of shares on the Toronto Stock Exchange. The company said the new capital would position it to pursue strategic acquisitions and expand its global footprint. With its share price more than doubling this year, Kraken broke through the $1 billion valuation mark in September and is now worth $1.84 billion.

CoLab Software

CoLab in November announced a US$72 million (C$100.9 million) Series C funding round, the largest VC financing in Atlantic Canada in the past two years. The Y Combinator alum makes collaboration software for 3D modelling and in June launched its first AI agent, which it calls AutoReview. The company said at the time it was on pace to nearly triple revenue in 2025.

Spellbook

Spellbook, which makes AI products for law firms, closed a US$50 million (C$70 million) Series B round in October led by Khosla Ventures, one of the top venture capital firms in Silicon Valley. Based in St. John’s and Toronto, Spellbook said the deal valued the company post-money at US$350 million, or C$490 million. About 115 people worked at Spellbook at the time of the deal, and CEO Scott Stevenson believes that number will double in the next year or two.

Sparrow BioAcoustics

Sparrow said the $10 million in new capital would support its next phase of growth as it aims to sell its FDA-cleared Stethophone platform to hospitals across North America. The company calls Stethophone the world's first cardiac AI platform delivering bioacoustic detection of structural and rhythmic heart anomalies directly through a smartphone. "In the past year, about 40,000 patients and practitioners have used Stethophone, uncovering thousands of cardiac anomalies that might otherwise have gone unnoticed until later stages of disease," said Dr. Yaroslav Shpak, the company’s Chief Medical Officer. Killick Capital and Klister Credit led the round with participation from Pelorus VC, 98827 Newfoundland & Labrador Inc., and Brinex Capital.

All of which is not to say there have not been big deals in the three Maritime provinces. In Nova Scotia, the two-year-old medtech company Sound Blade Medical, which has developed a handheld tool that cuts tissue with sonic waves, closed a US$16.5 million Series A funding round in January. And Mara Renewables, the Halifax company that produces omega-3 products from algae, raised US$9.1 million in July. (We did not include the $52 million raised by GoodLeaf Farms even though the company was founded in Halifax. It is now based in Guelph, Ont.)

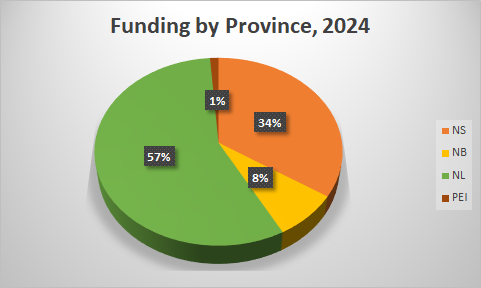

One final note about the provincial breakdown in funding is that this is the second year in a row that Newfoundland and Labrador has owned the podium, so to speak. In 2024, NL companies raised a total of $146.9 million, which was 57 percent of the $259.1 million raised by Atlantic Canadian startups in 2024.

Here’s another stat that’s worth chewing over: Since Jan. 1, 2023, innovation-driven companies in Newfoundland and Labrador have raised $518.5 million. That’s half-a-billion dollars of capital injected directly into the province’s fastest-growing companies, substantially owned by Newfoundlanders. And that’s on top of the benefits the province received from the landmark US$2.75 billion acquisition of Verafin by Nasdaq in 2021.

It will be interesting to see what happens on The Rock in 2026.