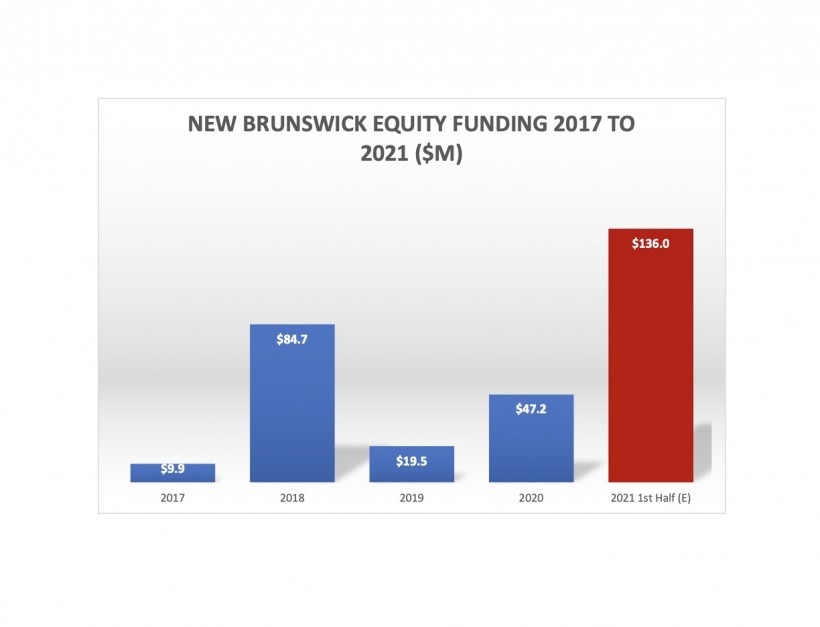

Six months into 2021, New Brunswick startups have already blown past their fundraising totals from previous years, with at least $136 million of capital raised.

Most of that money comes from Introhive’s record-breaking C$122 million Series C funding round, announced Wednesday -- the largest in the province’s history and one of the largest ever in Atlantic Canada. As well as the Introhive deal, the Canadian Venture Capital & Private Equity Association has said New Brunswick accounted for $14 million in the first quarter.

For New Brunswick Innovation Foundation Director of Investments Raymond Fitzpatrick, the funding is a sign that the province’s startup ecosystem is bearing fruit.

“Deals like this are exciting,” he said. “Obviously because of the dollar amount today, it does show an accumulation of a lot of effort.

“I don't think we can abandon what's been set up. I think if we stopped feeding the funnel at the very earliest stages, then big deals like this would become much, much harder to come by ... I think we're well positioned right now.”

New Brunswick’s previous best year for fundraising was 2018, when the province’s startups raised almost $85 million. The years 2019 and 2020 were more lackluster, at $19 million and $47 million respectively.

Introhive’s mega-round, though, could signal the beginning of a sea change.

NBIF is a repeat investor in Introhive and wrote the largest single cheque in the government agency’s history as part of the latest raise: C$1 million.

Fitzpatrick said the Introhive deal is evidence that the province’s growing network of incubators, accelerators and funders is succeeding in building an innovation economy capable of competing with more established centres.

Read our Report on Introhive's US$100M Funding Rround

NBIF decided to back Introhive’s latest round at the beginning of the pandemic, when it began to review its portfolio companies’ prospects for surviving the downturn and flagged the sales AI startup as a particularly strong contender.

“We really saw just the strong growth that the company had,” Fitzpatrick said. “It was a company that we couldn't by any means back away from even if we had limited resources.

“We got in particularly well-positioned, they had a strong management team, and we had to do everything we could to make sure that we could kind of get through the initial blip that was COVID… And obviously, that gamble worked out really well.”

Fitzpatrick said he expects to see more large funding deals in the future, particularly because once a region starts to attract the attention of major investors, the network effects can snowball.

“Venture capital is a big network,” he said. “If you can call up Jody (Glidden, CEO of Introhive), because you think you're at this stage, hopefully you can make an intro to a fund that he has an established relationship with. Your odds of success and actually getting interest or a possible investment... go through the roof.”

From Introhive’s perspective, the technical talent available in New Brunswick has also been a boon and is a key reason the company still maintains head offices there, global vice president of sales Adam Draper said in an interview.

Several of Introhive’s senior executives, including Draper, are also former employees at Radian6 – itself one of the crown jewels in New Brunswick’s startup community until it was sold to Salesforce for US$276 million in cash and US$50 million in stock in 2011.

The interconnectedness of the two companies bolsters the idea that New Brunswick’s innovation ecosystem is not just a disparate collection of companies, but a real community.

“I have some great relationships with some of the founders of both Q1 Labs and Radian6,” said Glidden in an interview. “And I would say I’m really proud of those guys and have definitely tried to learn everything I could about the journey that they were on.”