Having worked for decades in the technology industry in Israel, Alicia Ismach sees huge opportunities for Atlantic Canada’s tech sector in general and financial technology, or fintech, in particular.

The native of Argentina was hired as Entrepreneur-in-Residence by New Brunswick innovation hub Venn Innovation in October, 2018. And last year, she began to gather fintech players together to form a group to promote the segment. This culminated in the 10-company Atlantic Fintech Mission to Las Vegas in October for Money 20/20, the world’s largest fintech and payments trade show.

Now she wants to further her work in fintech in the region by bringing together all Atlantic Canadian companies whose solutions could be adopted in financial services. The goal is to increase connections between entrepreneurs and to help international companies understand the strength of the financial community on Canada’s East Coast.

“You have a great high-tech industry and you are great at ignoring it,” said Ismach in an interview. “It’s only by connecting the community that it can thrive and grow. We have a lot of knowledge and experience that can benefit all of us better if the community is connected.”

Ismach spent more than two decades in Israel’s celebrated technology sector, having worked in several fintech startups, mainly in log-in and payment systems. She was a Co-Director of the Founder Institute in Israel and a board member of the American-Israeli Chamber of Commerce.

What she’s discovered since moving to Moncton is that Atlantic Canada has a vibrant tech community but one that needs to do a better job of promoting itself internationally.

“We are in a very good location,” she said. “Israeli companies work mainly in North America and when they research what their options are, they research Atlanta, California, New York. . . . If they consider Canada, they will talk about Toronto and Montreal, maybe British Columbia because it’s close to California. Atlantic Canada is never on their map, but I want them to understand that Atlantic Canada is open for business.”

The region offers a strong workforce with both technology and business talent, a reasonable cost structure and proximity to such financial centres as New York, Atlanta and Toronto, she said. What’s more, she has discovered a stable of more than 100 fintech companies in the region, which she believes should be working more closely together.

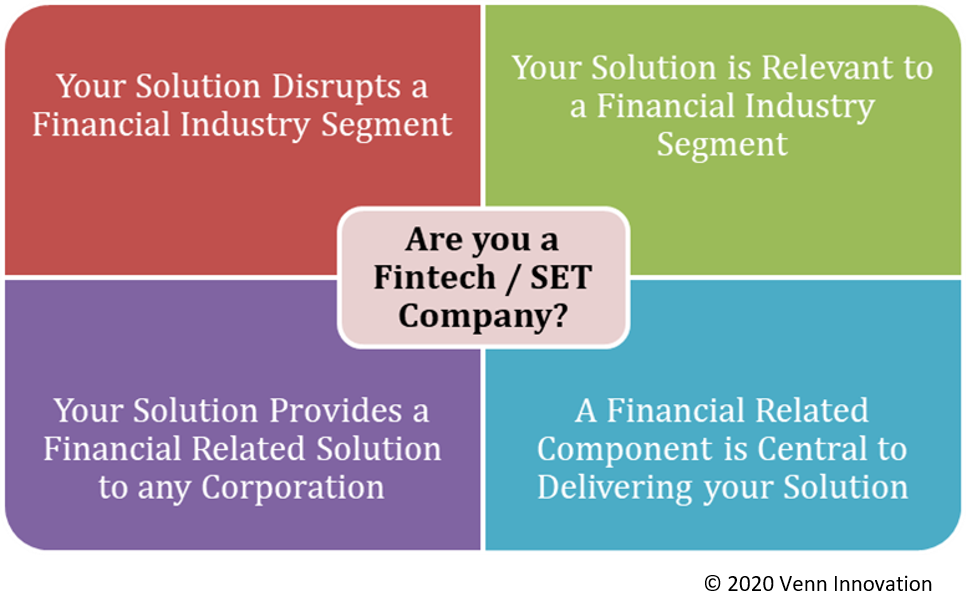

Ismach has a broad definition of fintech, really including any company whose technology can be used by financial companies. She wants these companies to unite and work together to build each other up and promote the region. She’s hoping to connect with any company that wants to be involved in such a group.

She would also like to improve the links between Atlantic Canada and Israel, and has been involved in establishing the Maple & Honey Forum, a conference in Tel Aviv in May to promote relations between the Israeli and Canadian IT communities.

She would also like to improve the links between Atlantic Canada and Israel, and has been involved in establishing the Maple & Honey Forum, a conference in Tel Aviv in May to promote relations between the Israeli and Canadian IT communities.

Israel, she said, only had 90 fintech companies in 2009, but after it formed a fintech support group it became a fintech powerhouse.

The experience at Money 20/20 validated her belief that the fintech segment in the region could grow strongly if it had better connections and more exposure, she said.

“When we took these 10 companies to Money 20/20, we had a lot of interest from organizations in the U.S., companies and leading opinion makers,” she said. “These 10 companies were only a small sample but if you take all the companies in the region, that would have a critical mass. . . . The world will recognize it. It will lead to partnerships and sales and growth.”