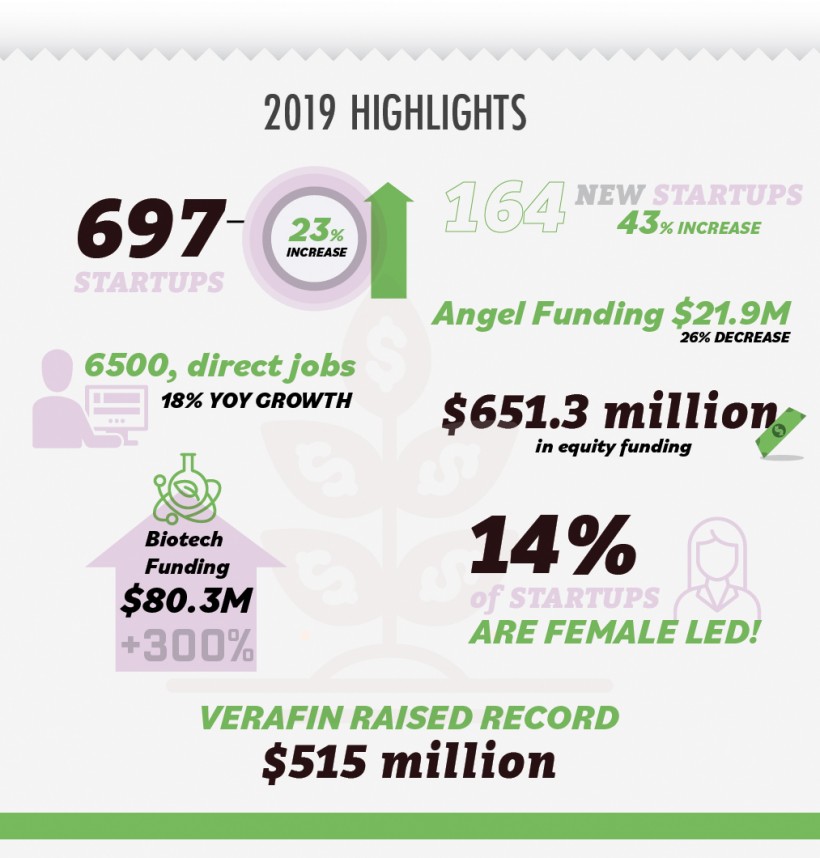

The Atlantic Canadian startup community set records for new companies, employment, and funding in 2019, but also experienced a worrying downturn in smaller financing deals.

Those are the highlights of our 2019 Atlantic Canada Startup Data report, which we’re releasing today. Click here to see the highlights and receive a full copy.

Though high-growth companies in the region raised a record $651.5 million in funding (more than three times any previous year), almost 80 percent of the total came from St.-John’s-based Verafin’s record $515 million equity-and-debt funding round. If the Verafin deal is stripped out, funding amounted to $136.5 million, a decline of 18 percent from the previous year.

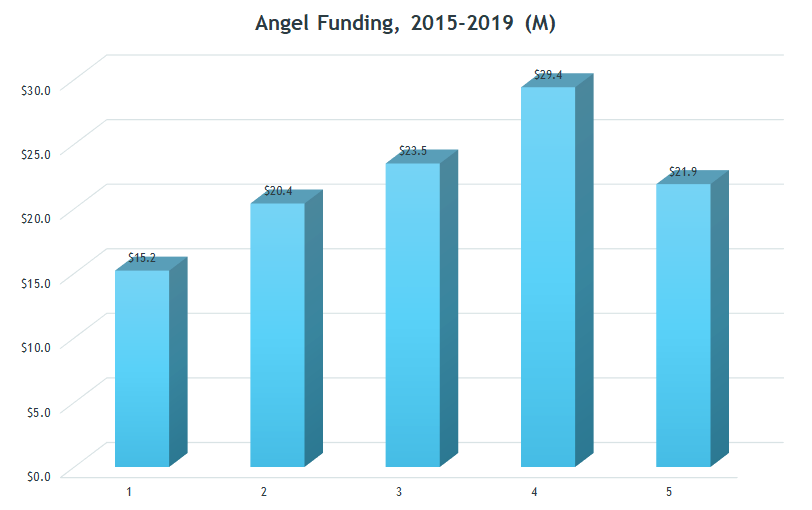

The report notes that angel funding in Atlantic Canada declined by about 25 percent to $21.9 million. Experts in startup development say such early-stage financing is essential to ensuring young, high-potential companies have enough capital to generate meaningful revenue. The decline in angel funding in 2019 was especially troublesome given that angel funding will likely decline further in 2020 due to the global pandemic.

“On the surface, the data in Entrevestor’s Atlantic Canadian Startup Community report suggests that 2019 was a fabulous year,” said Senator Colin Deacon, who read the report last week. “However, when you exclude the incredible Verafin deal, you quickly realize that investment dropped in 2019. This is troubling.

“A crucial measure of a healthy ecosystem is the quality and breadth of the highly informed investment it attracts. We need to examine all of our efforts to attract investment, and trim those that have marginal effect and redouble our efforts where there is strong evidence of effectiveness.”

Here are the 59-page report’s main findings:

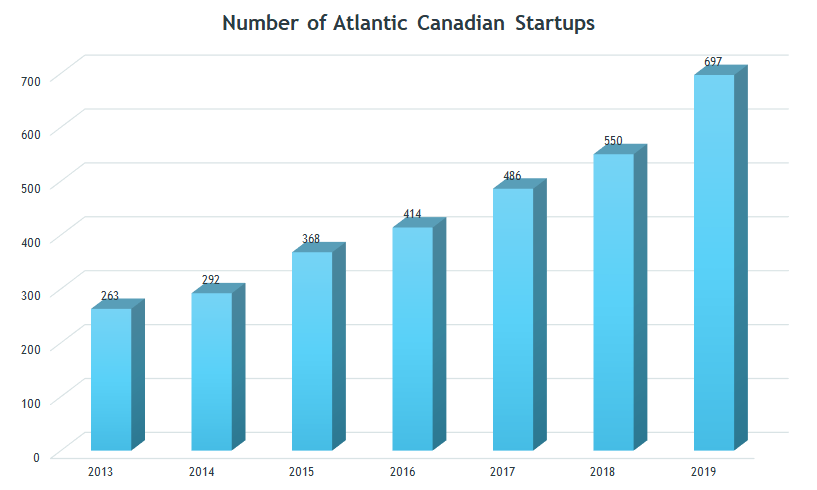

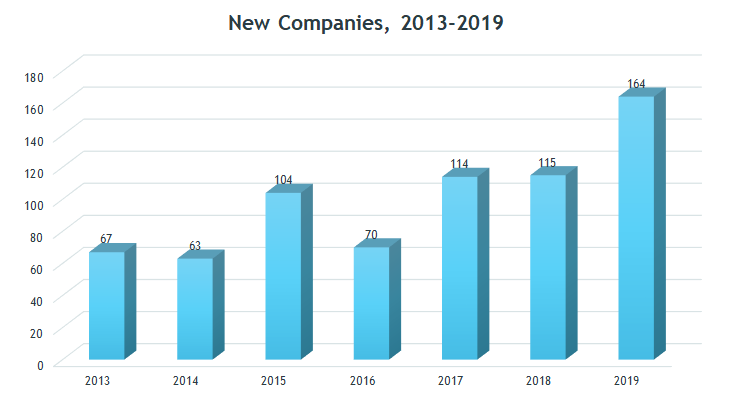

We tracked 697 companies in the Atlantic Canadian startup community – up 27 percent from 2018 and up 175 percent from 2013, when we began collecting startup data.

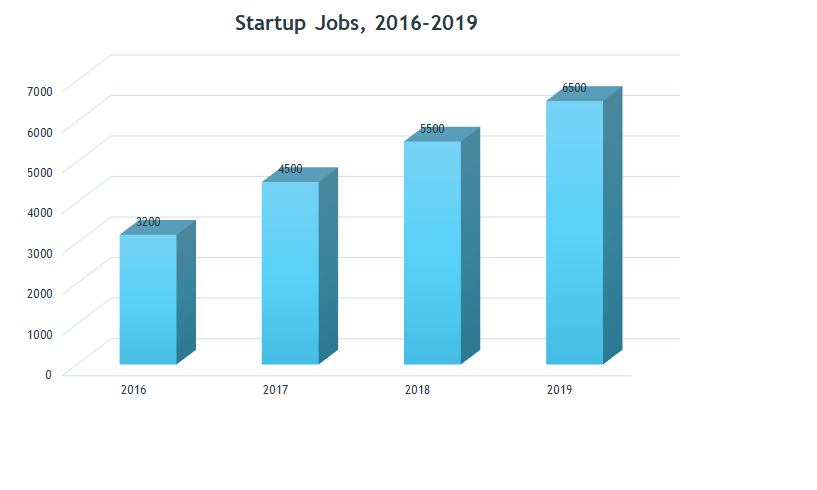

Atlantic Canadian startups employed about 6,500 people, 1,000 more than a year earlier. Overall, companies grew their staffs by about 23 percent.

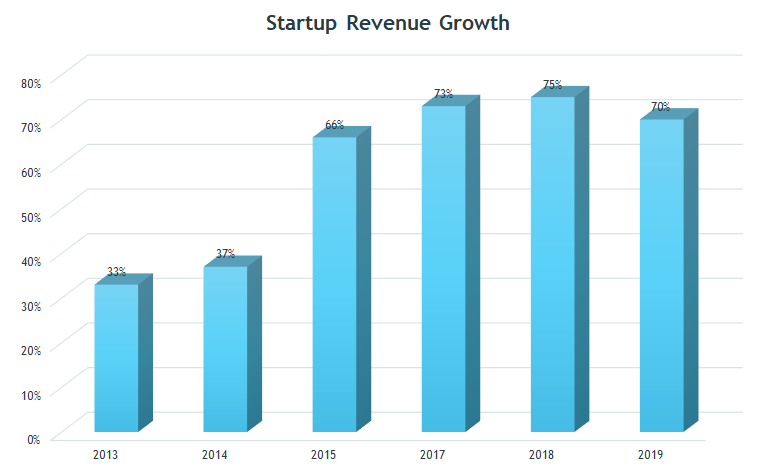

Companies sharing revenue data with Entrevestor reported revenue growth of about 70 percent – the third year in a row of 70 percent growth or higher.

Atlantic Canada launched 164 new startups – the first time the figure exceeded 115. It was 43 percent higher than any other year that we've been collecting startup data.

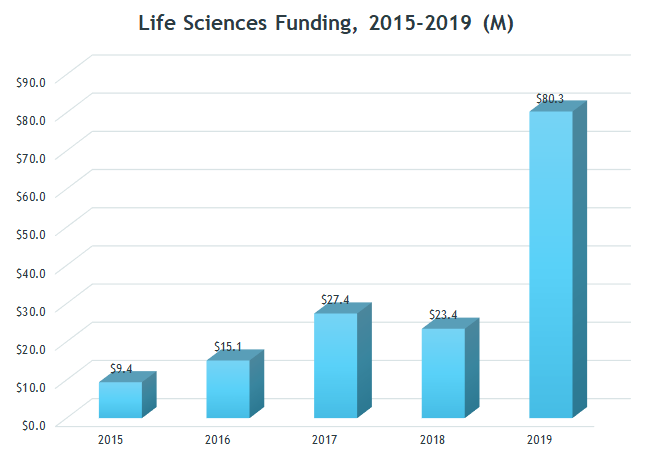

The life sciences sector continued to grow, attracting $80.3 million in funding – more than four times the 2018 figure. The greatest change in the sector in the past few years has been the improvement in C-level talent.

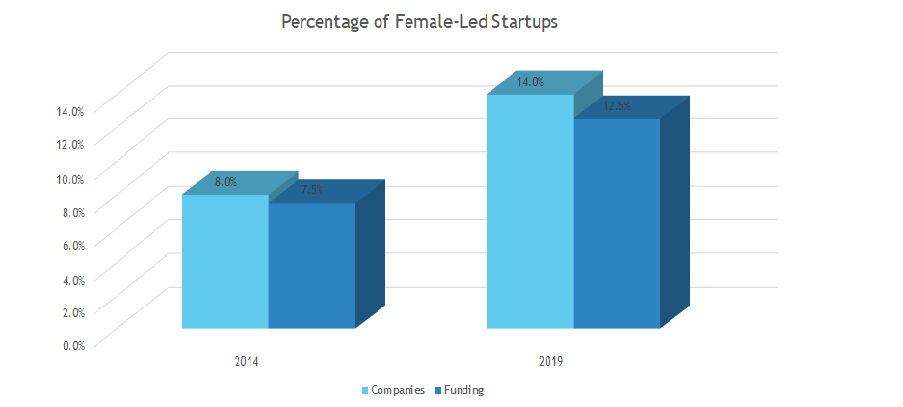

Some 14 percent of the companies are led by female CEOs or Co-CEOs, and these companies raised 12.5 percent of the funding in 2019 (excluding the Verafin deal). When we previously looked into the proportion of companies led by women in 2014, we found they made up 8 percent of the community at the time and received 7.5 percent of the funding.

Though best-known for its daily news on East Coast innovators, Entrevestor each year produces its Atlantic Canadian Startup Data Report – the most thorough assessment of the performance and growth of a regional startup community in Canada. This is Entrevestor’s seventh annual report on high-growth, innovation-driven companies in the region. The Atlantic Canada Opportunities Agency and Innovacorp led a group of supporters that allowed the study to be conducted and made public.