BIBLIOnomics, the Halifax startup that helps clients develop relationships with gifts of books, is one of the first companies in the country to land $35,000 in funding from the federal Scale AI program.

The boost from the federal government’s program that supports artificial intelligence enterprises comes as BIBLIOnomics met its 2024 sales targets and is projecting 10X growth for 2025. And it’s doing all this without having raised any equity investment.

Having bootstrapped for a few years, the company is now gaining traction by targeting the wealth management industry, helping them to build relationships with wealthy clients through gifts of books. It recorded $25,000 in revenue in 2024 with local early adopters, and is now planning a national campaign it hopes will bring in $250,000 this year.

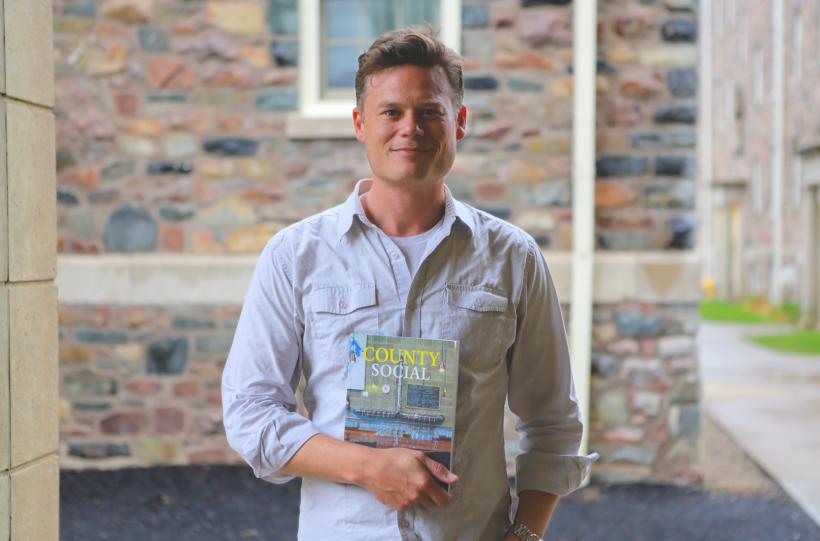

“It’s important to understand that BIBLIOnomics is the love child of a weird career path,” said Founder and CEO Alex Liot in an interview. “I’m a different kind of founder, doing different things in a different way. You think I should raise – I’m not going to. You don’t think I should offer market exclusivity – I will. The thing is, I’m crushing it.”

Liot is a veteran of the media and publishing industries. He sold newspaper ads for 15 years, then spent five years marketing books. He came to appreciate that books – printed editions that people hang on to for years, maybe generations – have a cherished place in people’s hearts. He also learned that book publishing is in serious jeopardy and he set out to help book sales, especially in Canada.

One advantage he found with books is that they have robust sets of metadata – that is, the data that describes the product, like the location, the genre, the author. It meant that AI could be used to search the metadata to find books that people would love. That focus on AI earned BIBLIOnomics a leg up in the Scale AI program.

The company, which operates out of Volta, finally settled on a business model called BIBLIOgifting, and believes the perfect market for its product is wealth management.

Here’s how it works:

Let’s say you’re a financial adviser hoping to attract or retain wealthy clients -- and to stand out from the legions of competitors with the same ambition. After meeting clients, you present them with a personalized card and a small box as a gift.

Inside the box is a list of 12 books, and the client can choose one as a gift. (BIBLIOnomics uses AI to go through databanks of 21,000 books to come up with a selection of 20 books. Then the wealth manager and BIBLIOnomics work together to narrow the list to 12 books.) Once the client chooses a book online, it’s delivered to them.

This is state-of-the-art relationship-building, says Liot, because the recipient will remember the gift in a special way, partly because they chose it. What’s more, the wealth manager has gained insights into the client’s character and interests, which will help in developing a long-term relationship.

One strength of BIBLIOgifting is it uses wonderful content from Canadian books, but it does not have to develop the content itself, said Liot.

“I am absolutely swimming – swimming! – in quality content, a thousand feet deep,” said Liot. “It is the exact articulation of why I think we are sitting on a gold mine.”

His company so far has not raised equity investment, in part because the market for investment has been weak in recent years. Liot has kept costs low, and devoted all his time to product development and sales, rather than courting investors. He’s open to raising capital should he meet his sales goals for 2025.

“We would likely benefit greatly from having capital at our most extraordinary growth trajectory,” said Liot. “The point is we want it to be our choice. We have mapped out a path that does not require a raise.

“Ironically it wasn’t my choice originally – it was forced upon me. It happened that I launched BIBLIOnomics in the same period when they doubled interest rates and VC collapsed. But it was fortuitous because I am a sales-driven founder.”