As we begin to dig through the data for our coming report on the Atlantic Canadian startup community, one theme that is emerging is the slowing growth of the community overall.

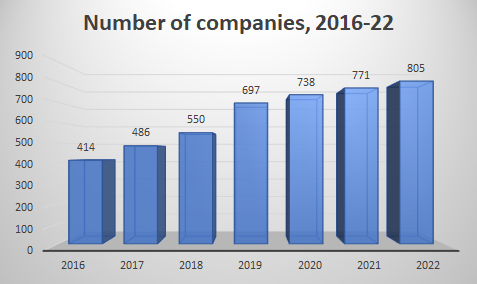

The preliminary data we’ve accrued so far shows there were 805 startups in Atlantic Canada at the end of 2022. Had the community continued to grow as it was before the pandemic, the number would be over 1,100. We’ll release the final data in our 2022 Atlantic Canada Startup Data report, which we’ll publish in the summer.

We’re beginning to see some interesting trends already, but we need more data. So we’re once again asking founders to please – PLEASE – fill in our survey. The response we’ve had has been great but we need way more completed surveys to get a full cross-section of the community. It's quick and 100% confidential. You can find the survey by clicking this link:

To put 805 startups into perspective, the number reflects a 4.4 percent increase over the 771 startups we had in our databank in 2021. It was the third year in a row that the startup community has grown at a rate of 4 to 6 percent, and that’s disappointing.

For the first seven years that we were tracking the Atlantic Canadian startup group, the number of companies usually increased by about 15 percent, and it was capped with a rate of about 26 percent in 2019.

Then the pandemic happened. Then people were slow to return to some of the work spaces. Then talent costs spiked. The result has been an apparent deceleration in the growth of the community.

I say an apparent deceleration because there may be a few factors cloaking what is actually happening. In the teens, there were more startup events, many of which drew out the rookie founders beavering away on new ventures. There were more demo days and pitching events. I get the sense that there are more companies in stealth mode now than there used to be, though of course it’s impossible to quantify that. (A message to stealth companies: Ping me at peter@entrevestor.com just to let me know you’re out there. Include your name, location, sector, and website.)

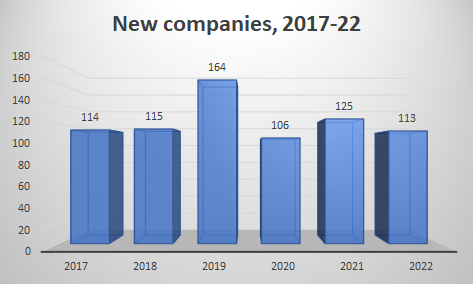

For 2022, we found 113 new startups across the region. It falls short of the 125 we recorded in 2021, but we may have a few more trickle in before we publish the report. And it’s consistent with the trend of the past few years when more than 100 new companies were formed each year.

There are a few interesting things to note about the new companies. A year ago, we were sounding alarm bells about the lack of new companies on Prince Edward Island. Not this year. We’ve recorded 13 new startups on the Island, which amounts to 18 percent of the total for that province. Twenty-nine new companies are based in Newfoundland and Labrador. (It’s the most visible market for new companies because of the regular Pitch and Pick events at Genesis and the Woodward Cup at the Memorial Centre for Entrepreneurship.) Almost 40 percent of the new companies are in Halifax.

Though IT is supposed to be going through a tough time with talent costs and demands for more sophisticated technology, 89 new IT companies (almost four-fifths of the rookie class) entered the databank for 2022.

On the flipside, we found 62 companies had failed in 2022, including a couple that had raised capital. The number of failures is down from 100 a year earlier. And we removed a couple dozen other companies from the databank because they moved away or we deemed them service companies.

Should we all be worried about the slowing growth in the startup community? Not really. We are seeing a few trends already in the data we’ve collected and there are reasons for optimism. But we need more data across the spectrum of startups to make firmer conclusions. Please get those survey responses in to us.