Innovacorp has cashed in on its investment in Metamaterials Inc., banking a gain of $101 million and making a return of almost 35 times.

Nova Scotia’s provincial venture capital Crown corporation invested a total of $3.1 million in 2015 and 2017 in Meta, as it’s now known, a Dartmouth-based maker of advanced materials that can alter light. Meta listed on the Canadian Securities Exchange two years ago, and its share price surged in June when it gained a Nasdaq listing in New York. At one point, it had a market capitalization (the total value of all its shares) of US$2.2 billion (C$2.7 billion).

Innovacorp has since sold its shares. Innovacorp, whose formal name is the Nova Scotia Innovation Corporation, has not yet announced the divestiture. But the Nova Scotia government on Thursday released its most recent Public Accounts, which included this single line: “In July 2021, Nova Scotia Innovation Corporation realized a $101.0 million gain on the disposition of an investment.”

An Innovacorp spokesperson on Friday confirmed that this referred to the investment in Meta, adding that with the sale Innovacorp's fund performance since 2015 is now in the top 5 percent of all VC funds in North America.

Meta produces materials that alter light, either by magnifying, repelling or filtering it. The company is best known for its metaAIR venture with Airbus, which is producing a transparent covering for airplane cockpit windows that can filter out laser attacks. But it is working on a range of other applications, from healthcare to geothermal energy. Last month, it agreed to buy Nanotech Security Corp., a British Columbia maker of security holograms, for $91 million.

On Thursday, Meta shares closed at US$5.11, giving it a market cap of US$1.4 billion.

When the shares began trading on the New York-based Nasdaq exchange in June, Meta noted that one of its largest shareholders was Innovacorp. However, the Crown corporation’s mandate calls for it to invest in startups rather then hold the shares of publicly listed companies. That and the opportunity to book a healthy gain no doubt led to the decision to exit the investment.

In venture capital circles, a 35X gain over six years is an astonishing return. To provide perspective, the New Brunswick Innovation Foundation made a gain of 28 times when it booked a $9.25 million gain in 2011 on its investment in social media monitoring company Radian6. The VC backers of Radian6 captured the Canadian Venture Capital and Private Equity Association Deal of the Year for 2011 after the company was purchased by Salesforce.com for $326 million.

NBIF retained those proceeds in its venture capital fund and has been reinvesting them in New Brunswick startups.

The gain on the Meta investment illustrates the new focus Innovacorp has adopted under the leadership of CEO Malcolm Fraser and Vice-President of Investment Andrew Ray. The organization has been stating it is operating more like a private venture capital agency with a greater emphasis on performance and seeking companies with the potential to gain a $1 billion valuation.

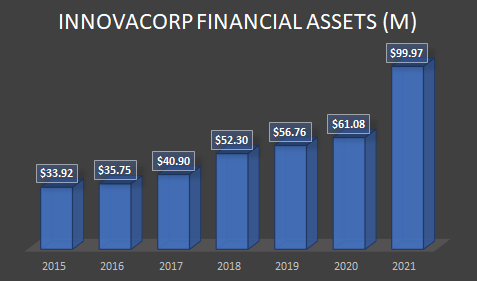

Source: NS Public Accounts, 2015-2021.

The Public Accounts for the past few years show that even before the Meta exit, Innovacorp’s investment portfolio was gaining value. The agency’s financial assets had tripled in the six years to the 2020-21 fiscal year, which ended March 31. (The Meta listing on Nasdaq and Innovacorp’s share of its Meta stake took place in the current fiscal year.)

Innovacorp may realize a further gain in the near future. It was an early investor in drug discovery company Appili Therapeutics, which listed two years ago. It’s understood Innovacorp’s shares are still subject to a lock-up and cannot be sold yet. Appili shares, which are listed on the Toronto Stock Exchange, have been trading in a range of 63 cents to $1.60 in the past year and closed Thursday at 93 cents.

Disclosure: Innovacorp is a client of Entrevestor.