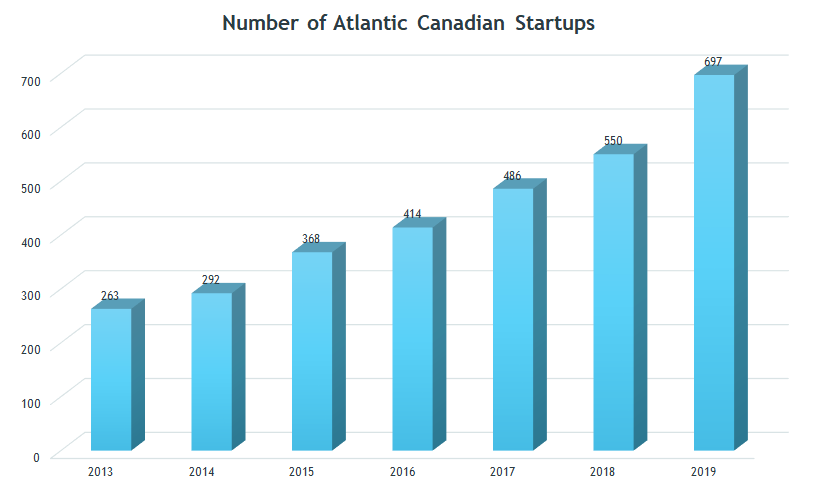

One of the highlights of our 2019 Atlantic Canada Startup Data report was the total number of new companies launched in the region.

We tallied up 164 new companies last year. Not only was that the best year ever for the creation of new startups, it was more than 40 percent better than any year in which we’ve been researching the Atlantic Canadian startup community.

In the early years of our study, we typically saw 60 to 70 companies launched annually, a level that jumped above 100 around 2015. In 2019, we witnessed another step change – up above 150. It’s too soon to tell whether the pandemic will stymie this growth in the short-term, but the experience of 2019 shows that Atlantic Canada has developed an effective ecosystem for testing entrepreneurial ideas and instructing teams on how to develop a product and get it to market.

Though it’s too soon to assess the overall quality of the new crop of companies, we do know a lot about them already. According to our data, these companies employed 158 people as of December 2019, or almost one paid employee per company. They raised a total of $3.3 million, of which $636,000 came from the founders themselves. Ten companies told us they had sales last year, one exceeding $1 million. In total, these companies had sales of $2.4 million. A further 20 new companies told us they were still pre-revenue.

Source: Entrevestor Databank

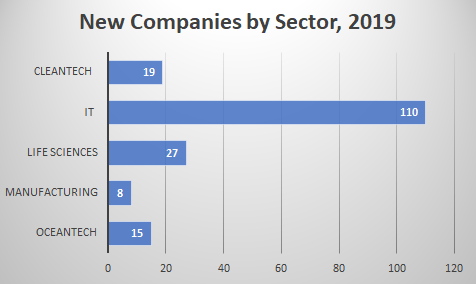

We counted 15 new ocean companies in 2019, some 13 of which were based in Nova Scotia. (Each oceantech company is counted twice -- once as a ocean company and once in the sector of its underlying technology.) Another sector that has had problems generating new companies in recent years is cleantech, but it is also a sector that generated the most new companies ever in 2019. There were 19 new cleantech companies last year, accounting for 38 percent of the 50 cleantech companies in the Entrevestor Databank.

Source: Entrevestor Databank

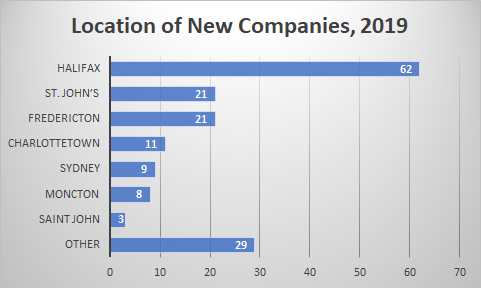

There is no surprise that Halifax has once again accounted for more than one-third of the new startups in Atlantic Canada, nor that it is followed by Fredericton and St. John’s. But there are a few things worth noting in the data on new company locations. The “other” category represents rural areas and small towns, and the number of companies in these communities has more than quadrupled, from seven in 2018 to 29 in 2019. One reason is the success of rural innovation groups like MashUp LAB and Ignite Labs, and their ability to work with larger groups.

Once again, Saint John has been struggling to create new companies. The Port City produced only six new companies in 2018, and last year the total fell to three. Truro (with four new companies) produced more new companes than Saint John. With the strength of its IT community and the braintrust of East Valley Ventures, Saint John should be able to generate more companies than it does and hopefully the growth of Block One will lead to more new companies.

The reason for the growth in new companies overall is the development of a comprehensive ecosystem that encourages the growth of new ventures.

These are the components:

o There are innovation hubs in most cities and several towns – such as Genesis in St. John’s and Planet Hatch in Fredericton – that offer not just meeting space but also curriculum. They are drop-in centres for anyone with an idea for a business.

o Most universities have entrepreneurship programs, centres or sandboxes. Most post-secondary students in the region have easy access to people with whom they can discuss entrepreneurial ideas. Many programs, like the Genesis Evolution program, are open to entrepreneurs from outside the university.

o Government and quasi-government bodies like Innovacorp and New Brunswick Innovation Foundation offer a range of programs offering instruction (and sometimes non-dilutive funding) to new companies.

o Propel’s Incite I program, which helps young companies assess product-market fit, is virtual and open to about 30 companies each year. For context, many of us can remember when Propel sounded foolishly ambitious in 2012 for saying its Launch36 program would nurture 36 companies in three years.

o Life Sciences groups in all four provinces are nurturing young companies, including the newest, Bounce Health Innovation in St. John’s. The BioInnovation Challenge has been attracting entrepreneurs with new ideas and training them to pitch.

o The oceantech community is concerned about not generating enough new companies, and several players have been holding meetups (more recently, these have been virtual due to COVID-19) to encourage more new companies. They could feed into programs at such institutions as Start-Up Yard at COVE or Ignite.

o The next phase of research-based entrepreneurship will unfold in 2020 and 2021 as Memorial and Dalhousie universities hold pilot programs in Lab2Market, a pan-Canadian initiative to encourage entrepreneurship among advanced researchers. University of New Brunswick has also been working on an I-Stem program, which has a similar focus on researchers.

An interconnected network of groups producing new companies has developed in the last decade, and that network will no doubt survive the pandemic and ensuing recession. Even if the number of new startups retreats in 2020, there’s reason to be optimistic about the ecosystem’s capacity to produce well over 100 new companies each year in 2021 and beyond.