Two massive funding deals in the life sciences segment and a pair of companies moving to the public markets were the highlights of the Atlantic Canadian startup community in the second quarter of 2019.

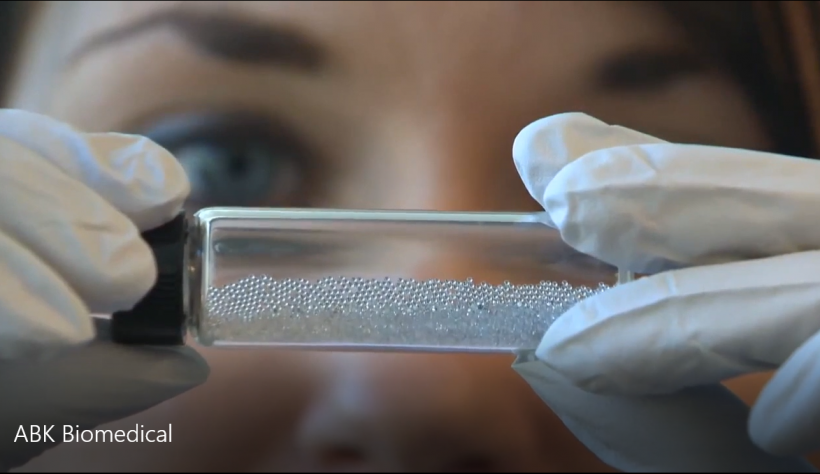

The biggest news was the US$30 million (C$40 million) venture capital round announced in April by Halifax medical device maker ABK Biomedical Inc., with which it hopes to bring two products to market. The funding round, led by Cambridge, Mass.-based F-Prime Capital, and Palo Alto, Calif.-based Varian Medical Systems, was the largest VC round ever announced by an Atlantic Canadian company.

Then in late June, Charlottetown-based MicroSintesis, which has developed a revolutionary product to ensure gut health in animals, raised $16.4 million from Halifax industrialist John Risley’s Northern Private Capital. The company is working in a new area of research called proteobiotic, which aims to rebalance the good and bad bacteria in an animal’s or person’s gut.

When we also consider that shares of Halifax’s Appili Therapeutics began trading on the TSX Venture exchange in late June, it was easy to conclude that life sciences dominated the #startupeast news in the April-June quarter. Appili raised $3.6 million earlier in the year.

What these deals mean is that some of the leading companies in the life sciences sector have either found significant capital, or a route to further funding. That will help them build their teams and finance their journeys through the regulatory process.

“How do you bring in talent if you don’t know if you will be able to pay people over the long-term?” asked ABK Chief Operating Officer Bob Abraham at the Atlantic Venture Forum in June. “This money brings security and the ability to incentivize your team, so it makes a difference for sure.”

The other big piece of news was that materials maker Metamaterial Technologies Inc. said it would seek a Canadian Securities Exchange listing, likely in September, with the hopes of raising more than $10 million. The Dartmouth-based company makes synthetic materials that alter light as it passes through them, and its target verticals include healthcare.

Two Halifax-area medtech companies – Spring Loaded Technology and Densitas – received a slice of an $11 million equity funding exercise anchored by the Montreal-based health technology organization Medteq. The companies declined to say exactly how much they received.

The other sector that produced big news in the second quarter was the oceantech group, which is a specialty segment in Atlantic Canada. On the last work day of the quarter, Canada’s Ocean Supercluster announced it would contribute as much as $5.9 million to Kraken Robotics’ OceanVision project, which will collect data from seabeds and store it in the cloud. The Supercluster is a regional R&D project that supports oceantech in Atlantic Canada.

Oceantech companies have been prevalent in the Creative Destruction Lab-Atlantic, which graduated its second cohort in June. The organization said its 23 graduates over two years have raised a total of $7 million from the CDL-Atlantic mentors.

In IT news, Mysa Smart Thermostats of St. John’s raised $2.3 million, which will add fuel to its accelerating sales and help to finance new products. And the New Brunswick Innovation Foundation invested $200,000 in TurboPlay, an ambition Fredericton group that aims to revolutionize the independent gaming market.

Note: This is our first quarterly roundup on the Atlantic Canadian startup community, which we will submit to Startup Genome for its page on Atlantic Canada.