Financial Post columnist Diane Francis popped a few entrepreneurial noses out of joint this week by saying Canada’s innovation craze is creating government-funded “Bombardier-like boondoggles”.

The founders and supporters of startups have taken issue with her claim that governments across the country are propping up “fake startups.” Francis’ main target is the National Research Council’s Industrial Research Assistance Program, which supports R&D by small and medium-sized businesses across the country.

The ire is especially frothy in Atlantic Canada, where Francis says “provincial agencies hand out money like Halloween candy.” Rory Francis, the head of the PEI BioAlliance, wrote a spirited rebuttal on the Post’s website, and several others weighed in on the New Brunswick Startup Community group on Facebook.

I want to add my two cents, and I have to disclose that these provincial agencies (along with universities, fund managers and private companies) are clients of Entrevestor. I don’t believe we’re creating “Bombardier-like boondoggles” and the data proves the point.

Diane Francis’ prose is not weighed down with excessive use of data, and the greatest evidence that the East Coast startups are not white elephants is found in their revenue metrics. If these young businesses are finding customers, then they are bona fide companies.

Read about our 2016 Analysis of the Atlantic Canadian Startup Community:

Study Shows Exits Bring $1.8B, 2200 Jobs to Atlantic Canada

2016 Was a Record Year for Funding in Atlantic Canada

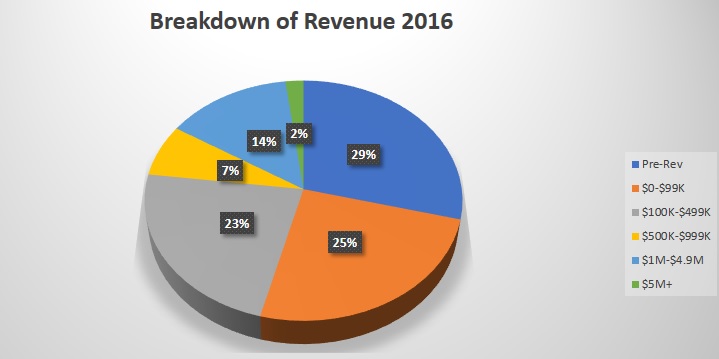

Data collected by Entrevestor for 2016 (the latest available) showed that 56 percent of the Atlantic Canadian startups surveyed produced revenue of more than $100,000 that year. A hundred grand in sales isn’t going to support a company. But it is an indication that more than half the startups in the region (and our survey has deep penetration across the startup community) have found a product-market fit. We also found that 31 percent of the total have annual sales of more than $1 million and 2 percent reported sales of more than $5 million.

These companies’ sales are growing at dizzying rates – those at the top of the pyramid are doubling or tripling sales annually. That’s how they got such high revenue in a few years. And in previous surveys, we’ve found more than 80 percent of the startups’ revenue comes from outside Atlantic Canada.

Yes, there are some weak Atlantic Canadian startups that are lingering about because they have government capital. But the majority of East Coast startups are finding clients and selling products.

What I find most troubling about Francis’ column is that Atlantic Canada is highlighted with British Columbia as the places where startups survive on government largesse. Like it or not, in corporate Canada, Atlantic Canada is seen as a little place where obsolete businesses are propped up by government. That’s our brand. Unfortunately, your brand is defined by others, not by yourself, and is really hard to change once it’s established. Consider Bombardier. Francis made a brief mention of the Quebec manufacturer in her column because all readers would associate the company with government-supported white elephants.

Diane Francis’ column highlights how this region and its young tech companies are perceived in some circles. It’s essential to change those perceptions. Several of those companies I mentioned at the top of the Atlantic Canadian startup pyramid are now raising capital, in some cases $10 millions or more. It can’t help if the investors they approach perceive their home as a place where fundraising is something akin to government-backed trick-or-treating.