An analysis of the 299 first-quarter job postings for Atlantic Canadian tech developers shows early-stage companies – not larger corporations -- are using most of the cutting-edge technology in the region.

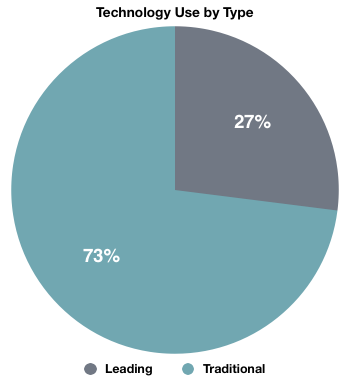

Our survey of three job boards in the region between December and mid-March 2018 found 299 technology jobs open in the region. Our research also revealed only 23 percent of the postings are for leading technologies. (These include technology using languages like Python, JSON or R and methods like RESTful, which are used in artificial intelligence, big data and blockchain.) The remainder of the postings were for such skillsets as project management, senior management and operational work within IT.

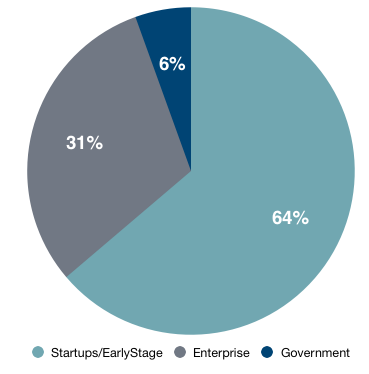

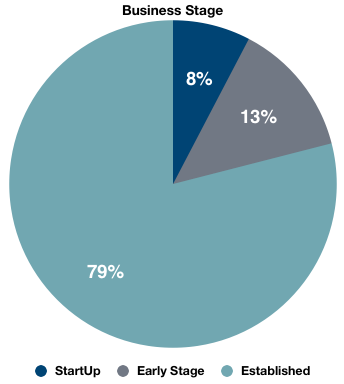

What we found interesting is that 64 percent of the companies advertising for leading technologies were in the startup or early-stage category. Given that these startups comprise a slim fragment of the region’s economy, this data suggests a fundamental weakness in the East Coast economy: a reluctance on the part of established companies to develop truly innovative technologies that could increase their growth. It is the startups that, for the most part, are looking for newer skills with emerging technologies such as blockchain, artificial intelligence and python or java languages.

Types of Companies Using Leading Technology

This is the first time we have conducted this research, and we hope this study will provide a baseline for further studies. The headline number for the study is about 300 openings in the first quarter, and we hope subsequent studies will establish whether demand for developers is growing in the region. As mentioned above, we found that almost three quarters these jobs are in traditional technology applications.

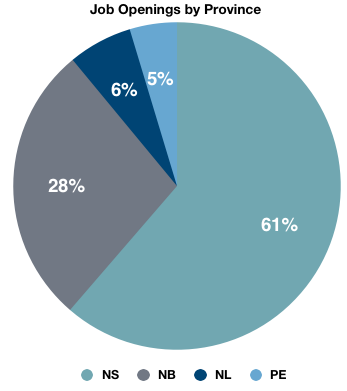

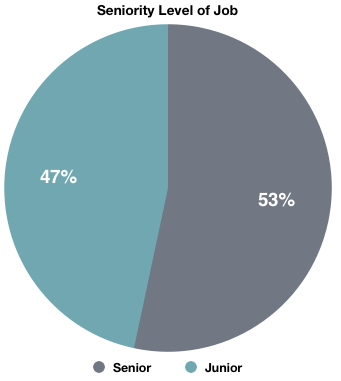

So what else are employers looking for? More than half of the openings are for senior developers, and more than 60 percent of the openings are in Nova Scotia. Here are a few charts that showcase job postings in both leading and traditional technology categories.

When we looked at the types of companies that are looking for developers, we found that only 21 percent were in the startup or early-stage categories. The remainder were jobs with larger technology services companies and a very few with provincial governments.

All of this might suggest that regionally, Atlantic Canadian companies are not innovating with newer technologies. It doesn’t necessarily mean they aren’t innovating at all. There is, for example, a high demand for engineering skills from electrical to industrial, especially in the oceans sector.

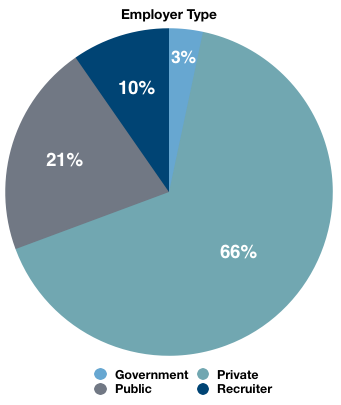

About two-thirds of the openings are for private corporations, while more than one-fifth of the postings were by public organisations, such as non-profits and public companies.

This is an initial study that we intend to return to in the next few months to look at trends. What’s interesting is the skills the market is looking for and who’s looking for them. For the larger employers, they’re seeking what we might call legacy technology skills for enterprise clients. These would include network administration, cyber security and platforms such as Microsoft, SAP and Cisco.

We need more data, and over a longer period of time to start drawing full conclusions. For now, the data is suggesting we need to think about these questions in Atlantic Canada and understand better if companies are innovative with technologies. Demand for certain technology skills across various sectors is a good indicator of what industry sectors are more digitally advanced than others.

Methodology

We analysed almost 300 jobs posted online in Atlantic Canada from December 2017 to March 24, 2018. These were all coded based on various criteria we determined, in a Google Spreadsheet, which is publicly accessible. We collected data through manual coding by visiting publicly available information on:

- CareerBeacon

- Workopolis

- Indeed

In addition, we reviewed job postings from the websites of members of Digital Nova Scotia and Newfoundland Association of Technology Industries, where member companies indicated current openings.

Information was coded in the Google Spreadsheet and refined in Excel with final graphs being designed in Numbers. The data is believed to be accurate at the time of analysis. Some job postings may have expired or been removed by the employer or operator of a website or online job posting board.