If there’s one piece of data that stands out from our study of the Atlantic Canadian startup community in 2016, it’s the number of companies that are gaining meaningful traction.

Last week, at the Halifax luncheon we co-hosted with Charcoal Marketing, we presented our 2016 research on the East Coast startup community to a full house. The highlight of the presentation was our research into exits in Atlantic Canada from 2011 to 2017, but we also delved into the metrics we collected just on last year.

Each year, Entrevestor tracks data on the startup community, basing the results on a survey of companies and on the hundreds of interviews we conduct each year. In 2016, we carried out our survey in conjunction with the Nova Scotia team going through the Regional Entrepreneurship Acceleration Program at MIT, and received 190 responses from company CEOs.

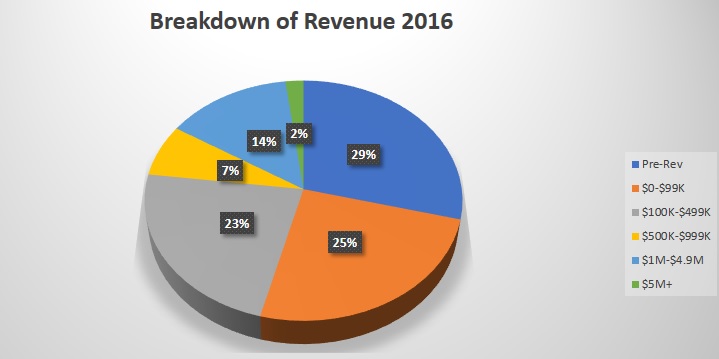

One thing we found was that 46 percent of our respondents are reporting annual revenue of $100,000 or more – up from 21 percent two years earlier. This fact is important because it shows that startups in the region are validating their products with actual sales to actual customers. By landing $100K in annual sales, they are for the most part selling to different customers and have found their product-market fit. It’s a sign that the startup community is producing bona fide companies not just a series of experiments.

Another positive sign: 16 percent of the companies have more than $1 million in annual revenue.

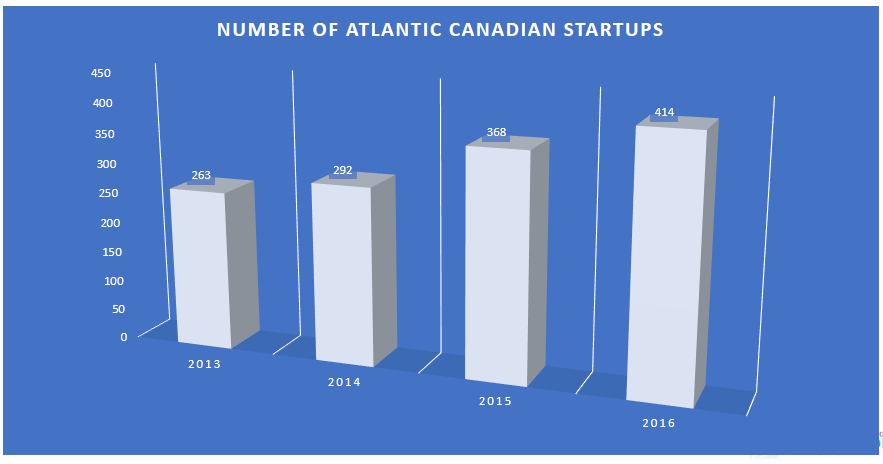

Other nuggets of information we presented last week include our finding that the number of startups in Atlantic Canada continues to grow. We define startups as locally owned companies that are commercializing technology and developing a product for the global market, and we tracked 414 of these companies in 2016. That’s a gain of 12.5 percent from a year earlier.

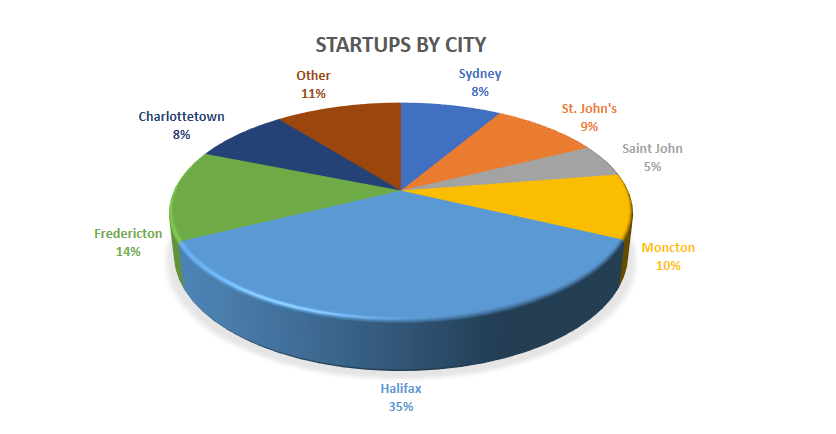

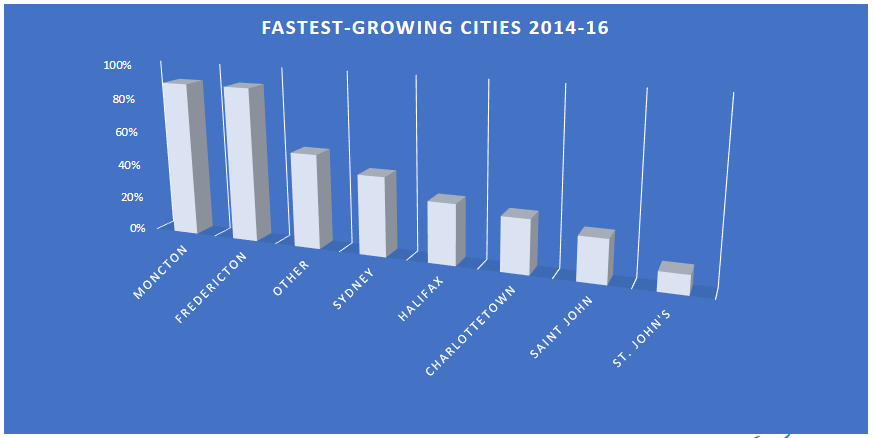

Halifax is the home-base for 35 percent of the startups in the region, which makes sense as startups tend to occur in large population areas. The striking thing to notice about this graphic is that only 11 percent of the startups in the region are based outside urban areas.

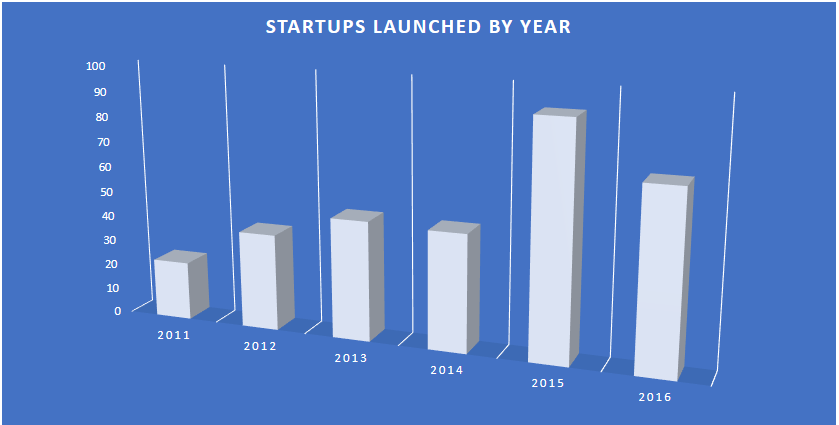

We counted 70 companies that launched in 2016, down from 91 in 2015. We found that 2015 was an unusually strong year for company formation, though we don’t have a clear explanation for the surge. Nevertheless, the production of 70 new startups last year was the second strongest company formation we've seen in the last six years.

The two cities adding startups the most quickly in the last two years were Moncton and Fredericton, mainly because of the work being carried out by Venn Innovation and University of New Brunswick respectively. We mentioned above that startups tend not to take hold in rural areas, but over the past two years the rural centres have been adding startups at a faster rate than all centres other than the two New Brunswick cities we just named.

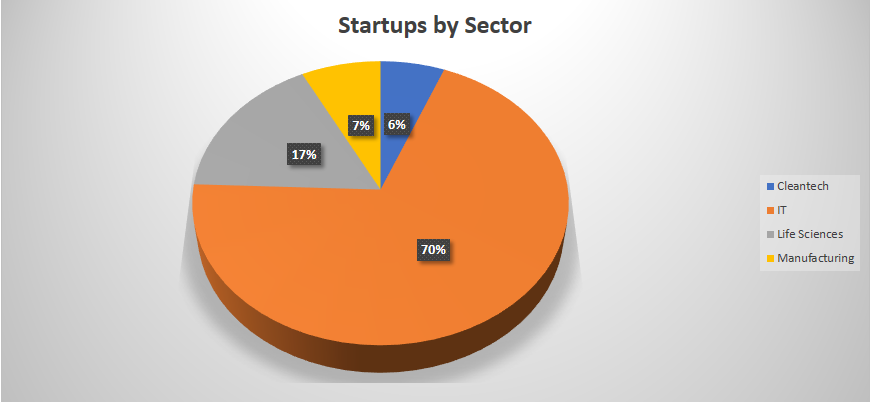

One final note, IT rules. Seventy percent of the companies we track are involved primarily in digital technologies.

Next week, we will wrap up our series of articles on our data research by looking at equity funding in 2016.

Please help us continue to provide startup community data: