A troubling divergence has developed in the Atlantic Canadian startup community as early-stage companies have difficulty launching even as their elder comrades grow rapidly.

This is the main conclusion of the 2021 Atlantic Canada Startup Data report, which we are unveiling today. This is the first of our annual data reports in which we have warned about early-stage founders experiencing undue hardship.

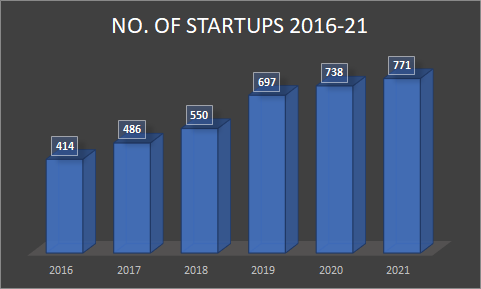

The East Coast Startup community comprised 771 companies at the end of 2021, an increase of 4.5 percent over 2020, the slowest growth we’ve ever recorded. Though the pandemic is one reason for the slowdown, we believe the main reason is increasing payroll costs – especially for software developers – making it difficult for young companies to get started.

“Developers specifically have been poached out of our regional workforce with significant pay increases,” said Propel CEO Kathryn Lockhart, after being briefed on our findings. “Though they remain in the region, we've lost their brain power – a different kind of brain drain.

“We are supporting founders at Propel by ensuring they are more equipped than ever before to recruit talent. Salary matters and so does culture, flexibility and opportunities for growth. Our population trajectory is a clear indication that people want to live here and it's up to us to ensure they can achieve success in doing so.”

Click here to download the 2021 Atlantic Canada Startup Data report.

Developers, if they can be found, now command salaries above $80,000 annually. This is one reason we witnessed 100 or more failures in both 2020 and 2021 and a factor in the startup community growing more slowly.

However, these headwinds afflicting early-stage companies were gusting while scaling companies enjoyed the best conditions we’ve witnessed. We cannot say that this environment has carried over into 2022, but the data shows that conditions were optimal in 2021, as can be seen by the following:

- Innovation-driven companies in Atlantic Canada raised $638.4 million, led by the $198.1 million secured by Dartmouth-based Meta Material Inc. when it listed on the Nasdaq. Investment was especially strong in New Brunswick, whose $244 million in funding included rounds of $122 million by Introhive and $61 million by Sonrai Security.

- Startups increased provincial government coffers as never before. The Nova Scotia government withdrew $101 million from Innovacorp, after the VC agency’s exit from Meta, and we estimate the Newfoundland and Labrador government made about $90 million to $100 million in taxes from the sale of Verafin to Nasdaq.

- A record 12 companies exited in 2021, more than in the previous two years combined. The wave of exits is long overdue, and it’s accompanied by a similar increase in corporate transactions. Some of these are significant deals, like Meta’s $91 million purchase of Nanotech Security.

- Startup revenues increased 53.8 percent, the first time in four years revenue growth fell below 70 percent. The deceleration is due to the increased number of mature companies, which tend to grow more slowly than scaling companies. If we strip out the companies whose sales exceeded $5 million, revenue growth increases to 70.8 percent.

- Companies’ staffing grew by a weighted average of 31 percent – far more than the customary band of 22 to 25 percent. Atlantic Canadian startups now employ about 8,800 people.

For the first time, our Startup Data report includes an analysis of diversity and inclusion, or D&I in the startup community. We are encouraged that one-fifth of the startups are led by women, which is a higher than percentage than in previous years when we assessed participation by female founders. However, it’s disappointing that they only raised 8 percent of the total funding in 2021.

The greatest D&I success is that immigrants head about 20 percent of the companies, and collectively they raised about a quarter of a billion dollars. There is still a distressing under-representation of Black and Indigenous founders, and we did not receive enough data to make definitive statements about the LGBTQ+ community.

Our research found Newfoundland and Labrador and Cape Breton are both boasting stronger startup communities than a few years ago. Newfoundland was the only province whose startup community is clearly growing. Half the NL startups are one or two years old, and the province added 41 companies in 2021, more than 40 percent of them in life sciences.

Cape Breton startups are finally raising meaningful capital, which is resulting in staffing increases. Aside from $6.3 million raised by Swarmio in its stock market debut, Cape Breton startups raised almost $12 million.

The region’s burgeoning Oceantech sector has been plagued by insufficient funding, but startups in this sector in 2021 improved equity funding to $22.7 million. The biggest change in the sector is that the Atlantic Canadian ecosystem has become an international hub for ocean-related startups.

The fastest-growing segment of the Atlantic Canadian startup community is once again life sciences, and the bio-startups last year attracted $75.4 million in funding.

Entrevestor produces the benchmark data for the Atlantic Canadian startup community. Each year, we add new companies to our databank and remove companies that have failed or exited, and survey as money companies as possible. Some 162 companies responded to our survey in 2021. Our team conducts hundreds of interviews each year with both founders and members of support organizations, which helps us to build on and analyze our surveys.

We would like to thank our prartners for supporting our research:

.png)