While the best startups in Atlantic Canada performed well in 2024, the region’s startup community overall witnessed declining numbers of companies and employees and a disturbing drop in early-stage funding.

These are the key findings of the 2024 Atlantic Canada Startup Data Report, launched today at an event in Fredericton, hosted by the New Brunswick Innovation Foundation. It was the most troubling Atlantic Canadian Startup Data report we have written since we began 11 years ago.

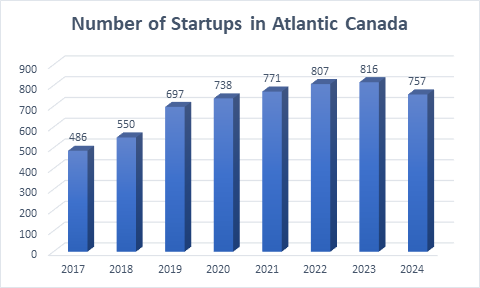

Overall, the Atlantic Canadian startup community is shrinking for the first time in recent memory. The overall number of companies in Entrevestor’s databank declined 7.2 percent to 757 companies, as we recorded 133 failures and only 118 company launches. We estimated total employment in the startup community was about 8,400 jobs at the end of 2024, compared with 9,100 a year earlier.

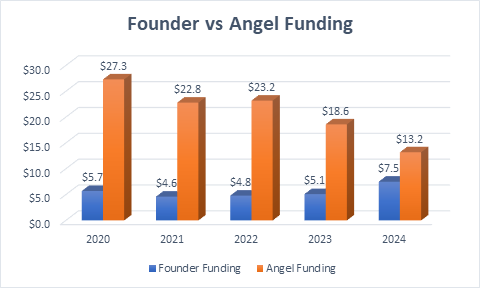

What’s striking is the poor funding results by early-stage companies. We examined companies launched in 2022, 2023, and 2024, and found that these 310 companies raised a total of only $6.2 million (of which $1.9 million came from founders) in 2024. Meanwhile, angel funding for all startups plunged to $13.2 million, down 29 percent from the previous year.

This challenging climate for fundraising is impacting the way startups are being mentored. Propel, for example, is encouraging startups in its programs to focus on generating early revenues to accrue development funds. Meanwhile, the advent of AI is producing the rise in “solopreneurs” – founders who can develop SaaS companies on their own with the assistance of AI agents.

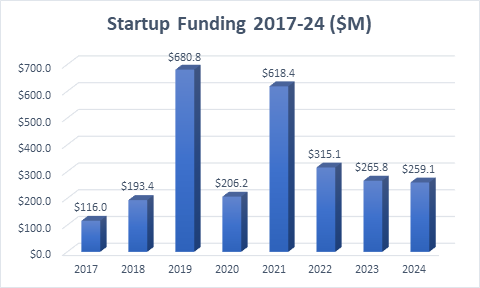

Of course, the news around funding is not all bad. We found a total of $259.1 million in equity funding by innovation-driven companies in Atlantic Canada. It was a solid year of funding and within striking distance of the $265.8 million mark of 2023.

In the first five years of this decade, the region’s innovation-driven companies attracted more than $1.5 billion in investment capital. There were also 35 exits in that time frame, including Nasdaq’s acquisition of Verafin for the equivalent of C$3.6 billion. When we add equity funding and exits, we see that the innovation community has brought more than $5 billion in direct investment into the Atlantic Canadian economy so far in this decade.

The 2024 funding total included $71.8 million raised on the TSX Venture Exchange by St. John’s-based Kraken Robotics, which continues to grow strongly and may become the region’s next unicorn. It was one of several Newfoundland and Labrador companies that closed major funding rounds, including CoLab Software (US$21 million) and Mysa Smart Thermostats ($11 million). In total, Newfoundland companies raised $146.9 million. Dartmouth-based Site 20/20, named to the Deloitte Fast 50 for the second year in a row, closed a venture capital round in August. The total of this round was not revealed publicly, but we believe it was the largest VC round of the year in the Atlantic region.

These major funding deals are a reminder that the core of the startup community continues to perform well, in spite of the shrinking stock of companies and challenging pipeline. The 737 companies in our databank include 33 Established companies, 58 Elite companies and 25 Scaling companies. The Elite category (which aims for annual revenue of $2M+, equity funding since inception of $4M+ and/or 20+ employees) added a net three companies in 2024 to reach the largest number ever. Though we have fewer Scaling companies than the previous year, the Scaling companies that shared revenue data with us reported average revenue growth of 181 percent.

Overall, we found a continuation of a trend we saw in our previous report in which a core of about 120 companies are flourishing, and many of the others are struggling.

Other highlights of our report are:

o The failed companies included some high-profile casualties, such as Meta Materials, once valued in the billions of dollars. Private companies like Saint John-based Millennia TEA and St. John’s-based Cyno, which we’d featured on Entrevestor because of their potential, are no longer operating.

o We found that 2024 was a solid year for exits, with five companies being taken over by multinational corporations. They included such venerable companies as Halifax-based B4Checkin and Dartmouth-based Precision Biologic.

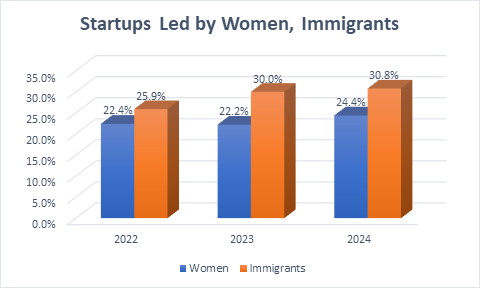

o Companies led by females now account for almost one-quarter of the community, and these companies outperform the broader community in just about every metric but one: funding. Female-led companies, for example, increased revenues by 50 percent – double the rate of the community in total. Yet female-led companies only raised $29.7 million in capital, which amounted to 16 percent of total funding after publicly listed companies were stripped out.

o In the three years we have been monitoring DEI metrics, we have found little improvement in the number of companies led by Black and Indigenous entrepreneurs. Black-led companies comprise 1.6 percent of the community, Indigenous-led companies 1.9 percent. These figures are little changed from three years earlier.

o The divergence between strong and weak companies is especially noticeable in New Brunswick. More than 13 percent of its companies were in the Elite or Scaling categories – a higher percentage than any other province. They included WeyMedia, best known for its CreditcardGenius product, which made the Deloitte Fast 50 with revenue growth of 431 percent over four years. But New Brunswick also suffered 39 failures and the total number of companies fell 12 percent.

The data for this report came from our daily reporting on Atlantic Canadian startups as well as our annual survey, which 119 startups completed.