With conflict of interest allegations leading Sustainable Development Technology Canada to temporarily halt new funding anouncements, East Coast cleantech founders are likely to be less affected than those elsewhere in the country because they were not receiving anywhere near as much funding from the federally backed, arms-length foundation to begin with.

SDTC's funding disclosures detail grants issued by the organization to fund private sector research and development work on cleantech and sustainable economy projects dating back to its creation in 2001. An analysis of the disclosures by Entrevestor reveals that East Coast companies have received a disproportionately small slice of the overall funding distributed, although almost all of the businesses that did receive financial backing were startups.

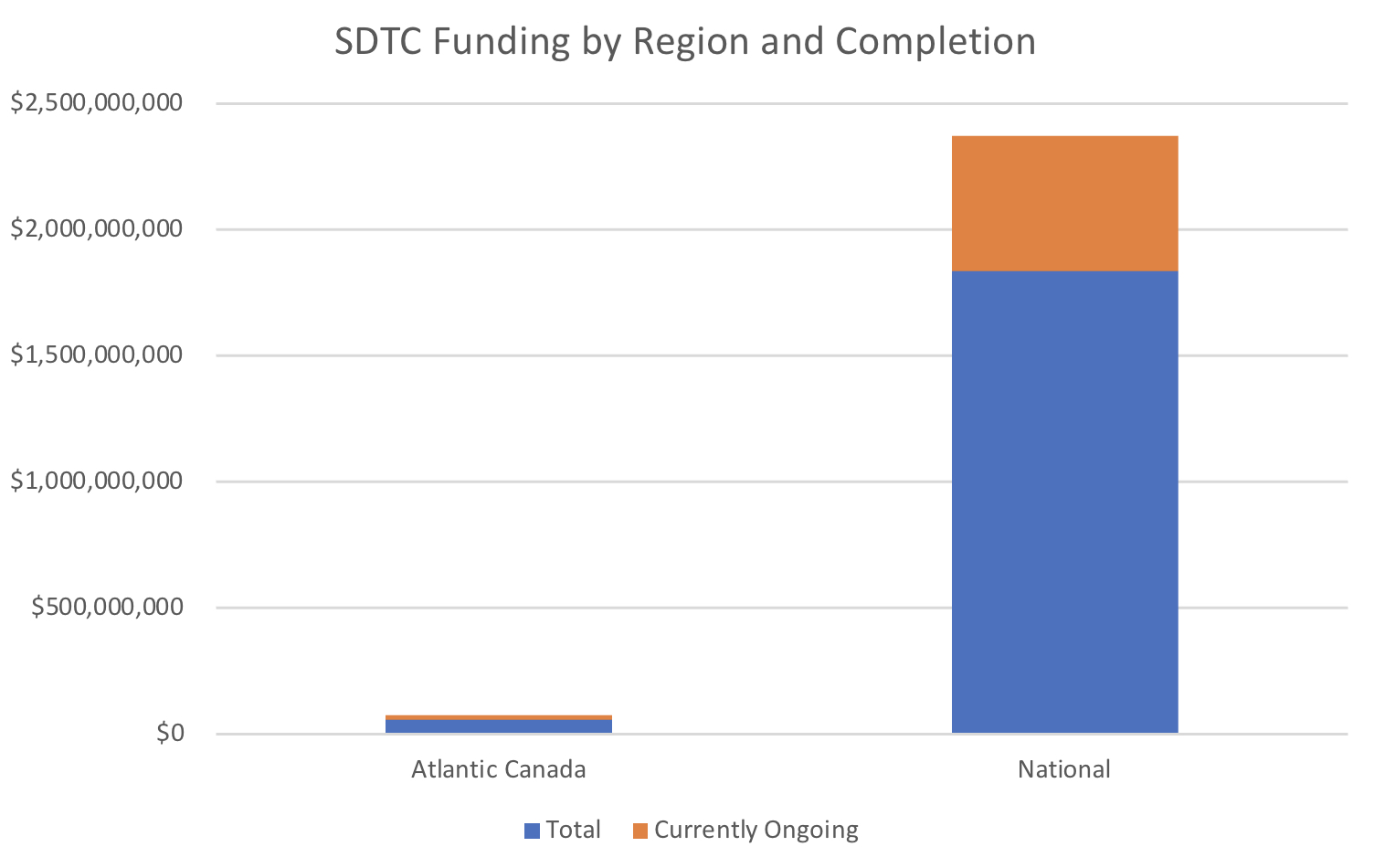

Over its 22-year history, the federally funded SDTC has distributed about $1.13 billion to some 638 private sector research and development projects, but just $40 million — about 3.5 percent — has gone to East Coast businesses, with 45 projects. And while SDTC has committed $536 million to currently active deals across the country, just $18.9 million of that will flow to Atlantic Canada, also representing about 3.5 percent. For comparison, the four Atlantic provinces accounted for about 5.6 percent of national GDP last year, according to Statistics Canada.

The pattern holds true regardless of the time period in question. Taking only projects that have been approved and completed since the beginning of 2018, SDTC has spent about $3.3 million in Atlantic Canada, representing just 1.3 per cent of the $263.4 million it has distributed nationally.

Mitigating the practical impact of the disparity is SDTC's status as a relatively minor player in the East Coast startup ecosystem. In 2021, an Entrevestor deep dive into the financials of the Atlantic Canada Opportunities Agency and National Research Council of Canada Industrial Research Assistance Program found that ACOA provided $21.3 million of non-dilutive funding to companies in the region, and NRC-IRAP provided $33.6 million. Only $600,000 worth of projects approved by SDTC that year have been completed, with just another $3.9 million worth of 2021 deals ongoing.

Of the currently active funding arrangements, the oldest is a $4 million, 2019 project with Fredericton agtech software-maker SomaDetect. Most of the remaining funding packages are from last year and this year.

SDTC fell under media scrutiny last week after Ontario-based startup news website BetaKit revealed it had obtained a copy of a previously unreleased report, commissioned by the federal government and compiled by auditor Raymond Chabot Grant Thornton, that found conflict-of-interest and governance issues at the arms-length foundation. Elsewhere in Canada, industry players have worried aloud about a potential funding gap being created by SDTC pausing its activities.

“We note the report found no clear evidence of wrongdoing or misconduct at SDTC and indicated that no further investigation is merited,” said the organization last week. “The SDTC Board of Directors and leadership team are carefully reviewing the report and are taking action to implement the recommendations as quickly as possible to minimize disruption to Canada’s sustainable innovation ecosystem.

“SDTC will suspend the approval of new projects and will not be accepting new applications until the implementation process is completed, which we anticipate will be by year end. Otherwise, regular business operations will continue, including the disbursal of funds for all existing projects in our portfolio in accordance with companies’ contribution agreements.”

East Coast founders who have already applied for funding stand to be affected by the investment freeze. Many of SDTC’s Atlantic Canadian deals have historically been approved during November and December. In 2022, SDTC approved four Atlantic projects in November, compared to 16 for the full year, as well as three in 2021 and four in 2020. In a statement, management did not clarify how the funding freeze will impact approval timelines for existing applications.

Companies in the region that have previously received backing from SDTC include rising stars like Halifax-based Milk Moovement, Meta Materials and Zen Electric. Milk Moovement in 2020 received $100,000 towards a $300,000 research and development project, before going on to raise US$20 million in 2022. Meta Materials received $5.95 million, up from a planned SDTC contribution of $5.4 million towards a renewable energy-related project. And Zen Electric earlier this year finished a $207,500 project, of which SDTC paid for $100,000, around the same time the company said it was preparing for mass production.

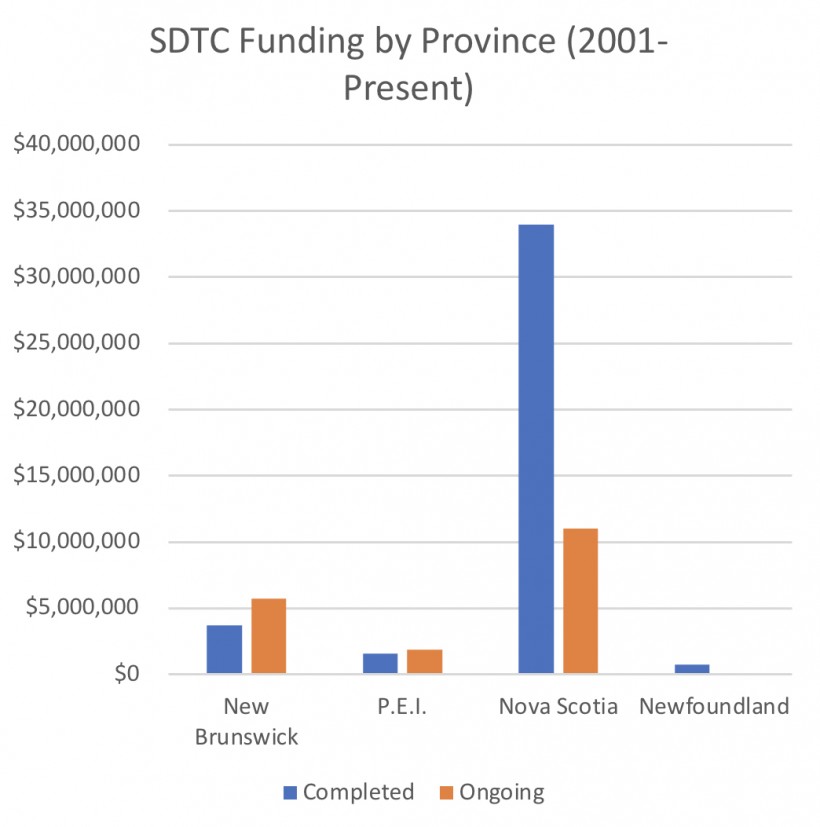

By far the largest proportion of SDTC funding in Atlantic Canada has gone to Nova Scotia, at just under $34 million, followed by $3.7 million for New Brunswick, $754,900 for Newfoundland and Labrador and $1.6 million for a lone initiative headed by P.E.I. ethanol-maker Atlantic BioEnergy in 2008. SDTC has also announced another $11.2 million worth of projects in Nova Scotia, $5.7 million in New Brunswick, a $100,000 project with Newfoundland software maker for the oil and gas industry Enaimco and a larger, $1.9 million project with P.E.I.-based Island Water Technologies subsidiary Sentry.

On average, the amount of money SDTC actually distributes for projects in Atlantic Canada is also less than it initially announces. The $40 million the organization has distributed in the region is almost 40 per cent less than the $66 million it originally promised for the same projects. Some of that discrepancy is because of deals that either SDTC or the funding applicant backed out of, but only in seven instances over more than two decades.