An investor contacted me recently to take issue with a perpetual bee in the Atlantic Canadian bonnet — the perma-complaint that there’s no funding available to startups in the region.

I’ve heard it for years. So has this investor. As a result, he dove into the data in CrunchBase, the American databank affiliated with TechCrunch that has information on startup investments from around the world. The investor, who asked not to be named, wanted to find data that would determine what proportion of our startups received funding compared to (a) the global startup community, and (b) the Top 20 global startup communities (such as Silicon Valley, Tel Aviv, etc.) as listed by the Startup Genome.

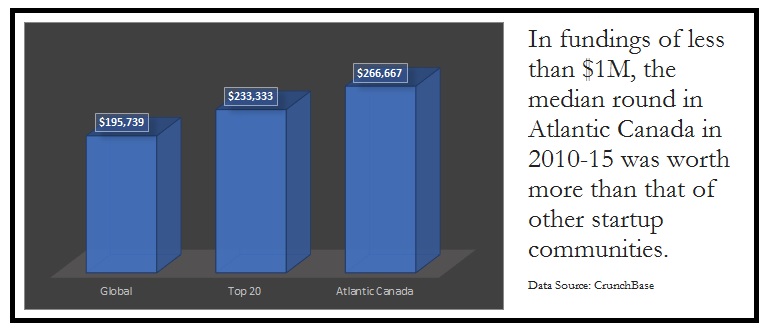

What he found was that in the six years from 2010 to 2015, Atlantic Canadian startups were more likely to raise pre-seed financing, which for the sake of this article we’ll describe as a round of less than $1 million. And in such rounds, Atlantic Canadian startups produced a higher median raise than in other centres, when considering both dilutive and non-dilutive financing.

“The data shows that Atlantic Canada is seeing high-levels of investment activity at the pre-seed level, supported by both equity investments and government programs,” said the investor. “This overall is a big win for the ecosystem. The important next step is for these companies to hit the milestones required to raise seed rounds and then Series A rounds.”

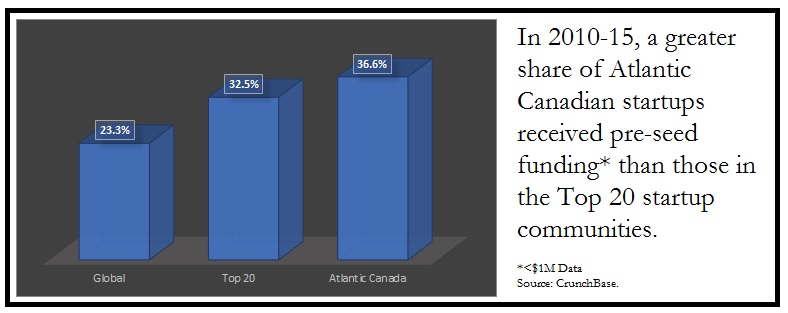

The first question the investor asked was what proportion of startups receive less than $1 million in funding. He tabulated both equity investment and money drawn from government programs, like the Atlantic Canada Opportunities Agency’s Business Development Program or NRC Irap. He calculated the percentage of startups in each year that had raised funding, then took an average of the percentages.

What he found was that 36.6 per cent of startups in Atlantic Canada were able to raise seed capital. That’s more than in the global market’s mark of 23.3 per cent. He also found that Atlantic Canada proportionally logged in more pre-seed rounds than the Top 20 communities.

There’s one caveat we should add here: The total base of companies are only those included in CrunchBase. That likely excludes a lot of smaller and newer companies, both from Atlantic Canada and other locations.

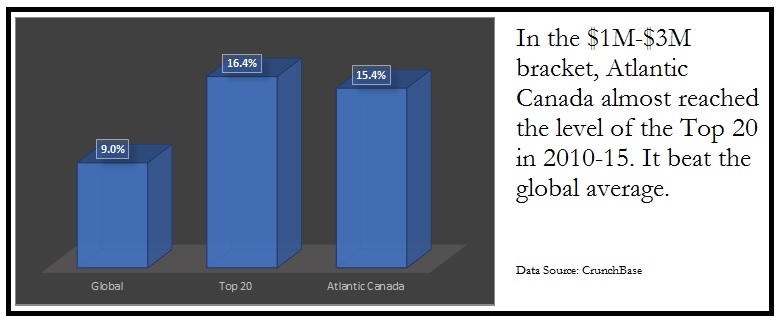

What’s more, even when he looked into funding rounds worth $1 million to $3 million, Atlantic Canada held its own. The proportion of East Coast companies receiving funding (15.4 per cent) in this bracket wasn’t as strong as the Top 20 (16.4 per cent). But we exceeded the global level of nine per cent.

Finally, our investor wanted to check out what the median pre-seed round was in Atlantic Canada and how it compared to other places. Again, he found that the Atlantic Canadian companies that did raise capital received more money than their peers in other jurisdictions. The Atlantic Canadian mark of $267,000 exceeded the global median by 36 per cent.

These findings should not be surprising. In fact, the performance of Canada’s East Coast might have been even stronger if 2016 had been included. Recent data from the Canadian Venture Capital and Private Equity Association has shown that Atlantic Canada last year was the top market in the country for pre-seed deals. We didn’t land any of the large deals that captured headlines, but Atlantic Canada accounted for about 11 per cent of the VC deals in Canada last year, though we have only six per cent of the population.

There’s funding available here, and companies are putting it to use.