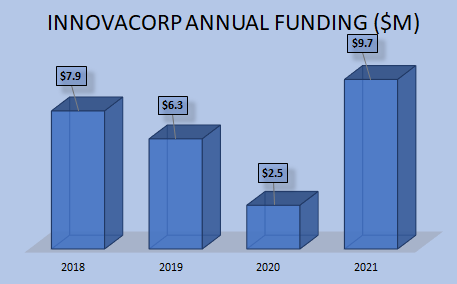

Innovacorp made a total of $9.7 million in venture capital investments in its 2021 fiscal year, as the Nova Scotia government’s early-stage venture capital agency ramped up investment.

The provincial Crown corporation, whose fiscal year ends March 31, released its annual Accountability Report late last year, and we came across the document recently. Though it’s a bit out of date, the report shows the provincial Crown corporation increased its investment from recent years, and the companies it has backed.

The report also includes metrics that would have been ignored a few years ago, reflecting Innovacorp’s greater emphasis in recent years on managing the fund to make returns for the province.

“Innovacorp made investments in 22 companies, advancing $9.7 million,” said the report. “Both the number of investments and the total amount invested was significantly higher than anticipated, with Innovacorp expecting to invest $4 million in 10 companies. The variance is due to the strength of the organization’s pipeline of investment opportunities as well as the team’s extra efforts to ensure its highest-potential companies had the capital they needed.”

Previous accountability reports showed Innovacorp’s investments totaled $2.5 million in 2019-20, $6.3 million in 2018-19 and $7.9 million in 2017-18.

The following are the companies that the agency invested in during its last fiscal year:

QRA Corp $1,652,000

Planetary Hydrogen $1,600,000

Oneka Technologies $1,000,000

Talem Health Analytics $600,000

Audioptics Medical $500,000

Axem Neurotechnology $500,000

Nexus Robotics $500,000

Proposify $500,000

Spring Loaded Technology $500,000

Densitas $450,000

Side Door $410,000

Graphite Innovation & Technologies $400,000

Swarmio $320,000

ReelData $250,000

3D BioFibR $100,000

Alter Biota $100,000

Impactful Health R&D $100,000

Emagix $50,000

NovaResp Technologies $50,000

Swell Advantage $50,000

Guild Solutions $25,000

Simbi $25,000

Innovacorp says in the report its main objective is to “generate a return for Nova Scotia” and it provides several metrics to assess its performance. For example, the report says the total value of the portfolio for investments made since 2010 was 2.05 times the amount invested, exceeding the agency’s target of 1.2 times. It added that the portfolio over this time is generating a gross internal rate of return of 15 percent.

The 2021 fiscal year ended before Innovacorp exited its holdings in Meta Materials Inc. for $104 million, but the agency has shed light on other portfolio companies that have exited. The report says Innovacorp made about $1.4 million on changes to the portfolio. A spokesperson for Innovacorp said these changes include $1.1 million from the partial exit of Truleaf Sustainable Foods and $100,000 from the exit of Marcato.

Another portfolio company that exited last year was Medusa Medical Technologies, which was purchased in March by Bellingham, Washington-based Emergency Reporting. The spokesperson said Innovacorp has maintained a stake in the new Medusa entity and makes income on that investment – $254,000 so far in 2021-22.

Disclosure: Innovacorp is a client of Entrevestor.