Atlantic Canada’s ocean technology sector is growing faster than ever, but Entrevestor’s 2020 Startup Data Survey shows possible trouble ahead on the funding front.

Although just a few years old, the segment has already achieved a degree of international reach unusual in the Atlantic provinces. Companies from other countries often attend the CDL Oceans accelerator and participate in the Oceans Startup Project, overseen by a number of organizations, including Canada’s Ocean Supercluster.

Provincial venture capital Crown corporation Innovacorp, meanwhile, now offers programming specifically for foreign-based bluetech companies eyeing moves to Nova Scotia. And Propel, St. John's-based Genesis's Evolution accelerator and the Emergence bioscience incubator all accept oceans companies into their accelerators.

The result is that the number of oceantech companies active in Atlantic Canada is rising steadily.

Entrevestor’s data shows that there were 101 oceans companies active at the end of 2020 – up 36 percent from the previous year. Of the 27 companies Entrevestor added to its databank for 2020, 13 were founded that year.

And of those that were not new, several moved to the region from other parts of the world, including Xocean, which is heading up a $3.4 million Ocean Supercluster project to develop self-driving boats.

The sector overall employs more than 1,300 people, and even some of the younger companies are generating revenue.

Funding availability, however, has not grown as fast as the rest of the bluetech economy. In fact, it continues to lag significantly, and most of what limited funding is distributed is non-dilutive.

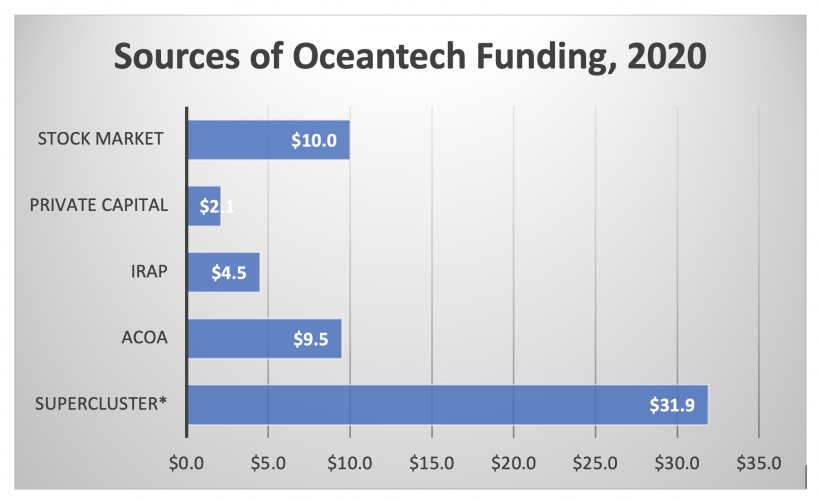

The Atlantic Canada Opportunities Agency gave out $9.5 million of grants and loans to bluetech companies in 2020, and NRC-IRAP distributed $4.5 million to oceans companies. The Ocean Supercluster, meanwhile, contributed $31.9 million, but private-sector research and development partners had to commit $24.6 million of their own capital to secure that funding.

Oceantech companies did raise $12.1 million in equity capital in 2020, but publicly listed Kraken Robotics accounted for $10 million of that. Omitting Kraken, Oceantech startups raised barely more than $2 million in 2020, down from $3 million in 2019.

In the 2020 Startup Data Report, Entrevestor Principal Peter Moreira wrote: "Startups in this sector simply have to raise more capital, which probably means they have to generate more revenue. If this situation doesn’t improve, the Atlantic Canadian oceantech sector runs the risk of being dismissed as a recipient of government handouts rather than a sound business proposition."

There remains, however, reason for optimism.

The CDL Oceans stream is developing a stable of angels who are encouraged to invest in young companies. And there are international funds cropping up targeting ocean technology, including seafood and aquaculture.

One breakthrough came in April, when aquaculture AI startup ReelData closed a $2.5 million round provided by Chicago–based S2G Ventures's Ocean and Seafood Fund. It was a breakthrough because it was the first time an Atlantic Canadian oceans startup drew VC funding from an international firm specifically set up for oceans–related ventures.

Innovacorp CEO Malcolm Fraser told Entrevestor in an interview that more VC funds and family offices want to back ocean ventures for ecological and financial reasons.

“When you look around the world, there are a number of funds that have come along in the last few years that are in this space,” he said.

“There’s no question from a global point of view there is a significant amount of capital that really likes the blue challenge. There’s an understanding that we have to make sure our oceans and the companies in them are cleaner, safer and better.”