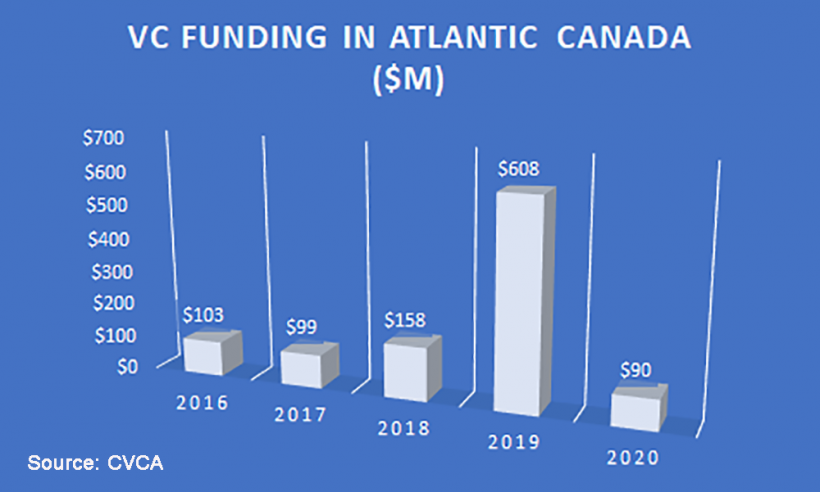

Atlantic Canada in 2020 recorded its weakest venture capital performance in at least five years and its best year ever in private equity, says the Canadian Venture Capital and Private Equity Association.

The national organization released its 2020 venture capital data report on Monday, which showed the four Atlantic Canadian provinces logged 34 VC deals worth $90 million. The report also featured a special feature on Pages 6 and 7 on VC in Atlantic Canada, which was prepared by Entrevestor.

The CVCA also released its private equity data for the year, which we don’t usually report on because there has been so little private equity activity in the region. However, there were 14 PE deals in Atlantic Canada in 2020, including the biggest buyout in the country last year.

“New Brunswick had the second-highest amount of dollars invested by province, including the largest PE deal of the year – Xplornet’s $2.7B secondary buyout with participation from Northleaf Capital,” said the report authored by CVCA Vice-President of Research Christiane Wherry.

Wherry asked Entrevestor to prepare a two-page summary of the startup and VC community in Atlantic Canada, drawing on our reporting as well as our own data. As well as the printed material in the report, we delivered our highlights in a webinar on Thursday attended by more than 80 venture capitalists from across the country.

In the broadest terms, private equity and venture capital differ in that PE usually involves investors taking majority stakes in mature-but-growing companies with strong cashflow in any sector. VC usually involves investors taking minority positions in high-growth, innovation-driven companies, possibly investing further in follow-up rounds.

In the past, Atlantic Canada has featured most prominently in the VC category, especially in 2019 when St. John’s-based Verafin raised $515 million in VC and debt in a single round. That accounted for the lion’s share of the $608 million in venture capital data raised in Atlantic Canada in 2019 – an off-the-charts sum that almost quadrupled the previous year’s total.

Venture Capital in Atlantic Canada, 2016-2020

| NS | NB | NL | PEI | Total | |

| 2020 | $65M | $10M | $9M | $6M | $90M |

| 2019 | $67M | $16M | $524M | $1M | $608M |

| 2018 | $67M | $78M | $5M | $8M | $158M |

| 2017 | $77M | $16M | $6M | $0 | $99M |

| 2016 | $64M | $32M | $7M | $0 | $103M |

It’s no surprise that the tally fell in 2020 after such a massive round by Verafin, and given that the pandemic and lockdowns deterred deal-making. The CVCA did not name the companies raising capital, but it’s obvious the largest deal in the CVCA figures was CarbonCure Technology’s round led by Amazon and Breakthrough Energy Ventures.

It’s worth noting that the CVCA did not include the US$20 million (C$26 million) round raised by Sonrai Securities. The company lists its headquarters as New York (which is why the CVCA didn’t include it), but we include Sonrai in the Entrevestor Data Bank as its whole development team and Co-Founder and CTO Sandy Bird are based in Fredericton.

If you include Sonrai in the 2020 total, the region produced $116 million in VC funding, the third-largest level in the last five years.

The report also listed Verafin’s US$2.75 billion sale to Nasdaq as one of the top venture capital exits of 2020.

The private equity data is more interesting because there was so much more activity in the sector in Atlantic Canada than in past years. In 2019, there were six private equity deals in New Brunswick – the only ones in the region – and there was no firm data on their value.

Last year, New Brunswick was second only to the red-hot market of Quebec in PE values, because of the massive Xplornet deal. New York-based Stonepeak Partners bought a controlling stake of Woodstock, NB-based Xplornet, Canada’s largest rural-focused broadband service provider, in June for $2.7 billion. Xplornet’s previous owners included New York private equity firms Sandler Capital Management and Catalyst Investors.

But there was more than the Xplornet deal. As well as six other small deals in New Brunswick, there were six private equity investments totalling $45 million in Nova Scotia and one worth $2 million in Newfoundland and Labrador.

What this likely means is that there are succession plans being executed at Atlantic Canadian businesses and private equity investors are backing these sales.

Canada overall experienced a weak year for private equity, said the CVCA, with $14 billion invested across 635 deals, down from an average of $21 billion in recent years. There were $4.4 billion in venture capital deals, the second-highest total on record, said the association.

“The second half of 2020 has demonstrated a real resiliency in the venture capital market,” said CVCA Chief Executive Kim Furlong in a statement. “The long-term health of the Canadian innovation ecosystem, including venture investment, is critical as we continue to navigate the impacts from the COVID-19 pandemic. It is imperative that we continue to grow the capital available to Canadian entrepreneurs. Venture capital is vital to Canada’s economic recovery and future growth.”