Nova Scotia venture capital agency Innovacorp has less money left in its main fund than it usually invests in a typical year, and hopes to replenish the fund through exits by existing portfolio companies.

The agency, which is owned by the Nova Scotia government, posted its annual accountability report for the year ended March 31 on its website this month. The report shows that, as of March 31, Innovacorp’s main fund, the Nova Scotia First Fund, had $5.5 million left to invest in Nova Scotian companies.

Over the years, provincial governments have placed $49.6 million in the fund, and Innovacorp has invested an average of $5.6 million in startups in the last four years. Now, the agency hopes to earn back money as the startups it has invested in are sold to larger companies or listed on stock exchanges.

“As our portfolio matures, we expect to see a return on invested capital through exits (and/or) acquisitions of portfolio companies — capital that can then be redeployed in new Nova Scotia startups,” said CEO Stephen Duff in an email. “Innovacorp management regularly reports to its board of directors on the NSFF’s capital status and works to ensure the fund’s sustainability through a blend of investment returns and new statutory capital.”

The investment focus moving forward will be on rewarding the more successful companies with follow-on funding, he added.

Sustane Deal Paves Way for Funding

The 2016 report was released as the Nova Scotia venture capital scene is undergoing some transition. The provincial government has allotted $25 million for a private-public fund that will be managed by a private fund manager. The goal is to find someone who can bring in private money, so a Halifax-based fund with scores of millions of dollars will invest in Nova Scotian and other startups.

Meanwhile, Innovacorp has been active, investing $6.3 million in 2015-16, more than 20 per cent more than the previous year. Seventeen companies received the investment last year, bringing the total number of companies in which Innovacorp has invested to 44.

The notion that Innovacorp could restock its larder through exits demonstrates that the agency’s management believes its portfolio of investments has matured greatly. So far, Innovacorp has reported only one real exit — the 2012 sale of Halifax-based GoInstant to Salesforce. It invested $100,000 in the company and is believed to have earned back about $1 million.

So far this year, two companies in the Innovacorp fold have been purchased for stock — transactions that don’t qualify as exits because they were small deals that did not return cash to investors. Livelenz in January was bought by Arizona-based Mobivity Holdings Corp., and in March InNetwork was taken over by gShift Labs of Barrie, ON.

[Disclaimer: Innovacorp is a client of Entrevestor.]

The companies Innovacorp invested in in 2015-2016 are:

| Information Technology | |

| Ubique Networks | $500,000 |

| Vendeve | $105,000 |

| PACTA | $100,000 |

| Clean Simple (now called Swept) | $100,000 |

| Shout | $50,000 |

| AioTV | $680,000 |

| Marcato Digital Solutions | $500,000 |

| Life Sciences | |

| Appili Therapeutics | $500,000 |

| Densitas | $250,000 |

| Health QR | $250,000 |

| ABK Biomedical | $753,000 |

| DeCell Technologies | $250,000 |

|

CleanTech and Ocean Technology |

|

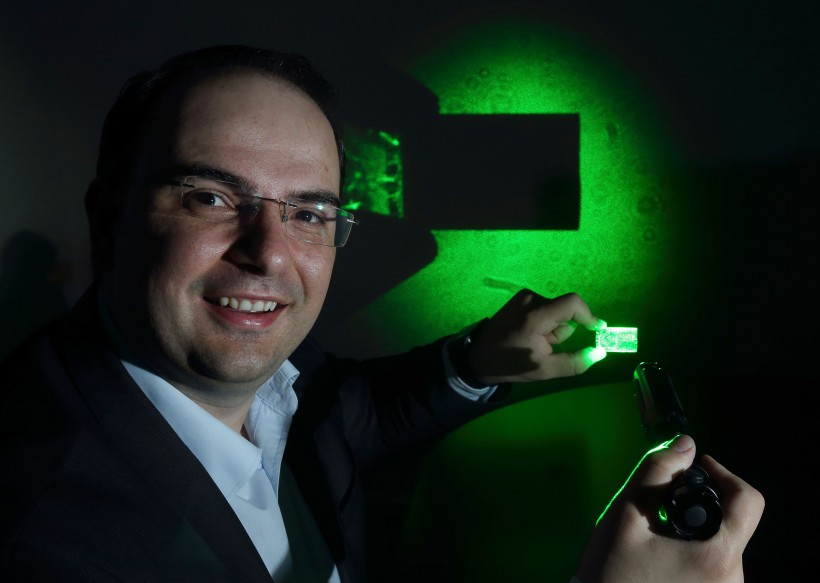

| Metamaterial Technologies | $1.5 million |

| SkySquirrel Technologies | $500,000 |

| Ocean Executive | $150,000 |

| Island Water Tenologies | $100,000 |

| Total | $6.3 million |