It’s difficult to quantify the growth of a startup community year to year, but there is one figure from our 2017 Atlantic Canadian Startup Data report that demonstrates what’s happening in the space.

On Thursday, we're releasing the highlights of the report and explained our findings to key stakeholders at a luncheon hosted by Business Development Bank of Canada. The report contains the best data available on Atlantic Canada’s high-growth innovation companies — commonly referred to as startups.

The report shows the four main metrics — new companies, employment, funding and revenue — all had a banner year in 2017. And there is one key finding of the report: Atlantic Canada has developed a core of substantial high-growth corporations founded on innovation.

When we surveyed these high-growth companies last year, just over 120 of them shared their revenue data with us, and in total they booked revenues of $51.3 million. What’s interesting is that two years earlier, we also got revenue data from just over 120 startups that completed our survey. Their total revenue for 2015: $26.2 million.

There are two reasons for the strong increase: about 17 per cent of the companies in 2017 reported revenue for the first time; and one-fifth of respondents reported 100 per cent revenue growth or better.

Other highlights of our report include:

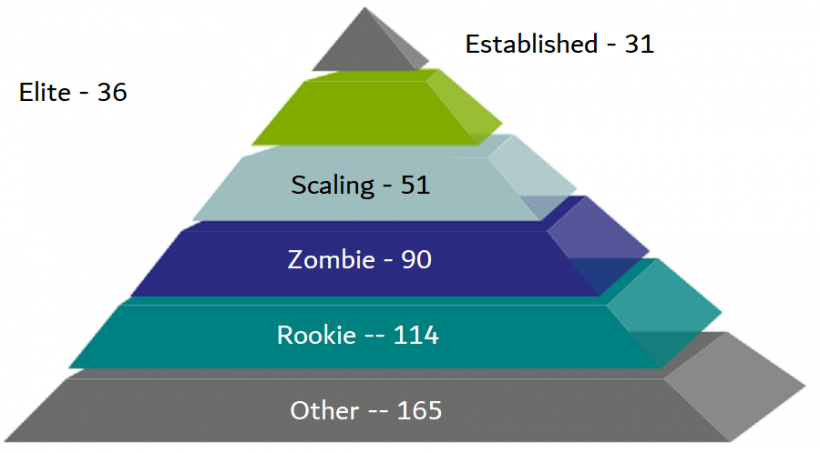

• New companies — We found that 114 companies launched in 2017, the highest number in the five years we’ve been collecting this data. It pushed the number of startups and high-growth companies we’re covering to 486, again the largest group of companies we’ve seen yet.

• Employment — We estimate there are now 6,400 Atlantic Canadians working for the region’s startups and high-growth companies (including companies that have exited). Some startups failed last year, but the companies that reported jobs data to us grew their workforces by more than 25 per cent last year.

• Financing — By our count, East Coast startups raised $116.1-million in 2017, and we believe there were a few deals that weren’t reported to us. It was the most equity investment in one year that we’ve seen yet. The financing was dominated by institutions outside the region, which are backing elite companies. This report shows that Halifax is now the cornerstone of the community, accounting for 43 per cent of the companies and 65 per cent of the capital raised. The jurisdiction that is improving most quickly is St. John’s, where companies reported 33 per cent growth in employment and a 178 per cent increase in revenues.

Other highlights: The number of startups headed by women has tripled in three years, and more companies in Sydney are reporting revenues, which rose 70 per cent from 2016. For the first time, there are enough OceanTech companies (35) to report on them as a sector in their own right.

Areas of concern include the apparent underperformance of Saint John, and the shortage of tech talent in several communities.