St. Mary’s University is adding a new dimension to the student entrepreneurship craze by having a group of students oversee their own venture capital fund.

The university’s Sobey School of Business is in the process of launching Venture Grade, which will be an investment fund to invest alongside existing investment vehicles. As of last weekend, the students had raised $47,000 aimed to end up with a fund worth $250,000.

Universities and colleges around the region (and the world) now have courses that help students to launch actual businesses. But SMU says Venture Grade is the first student-led VC fund, with the students raising the money and conducting due diligence on investments.

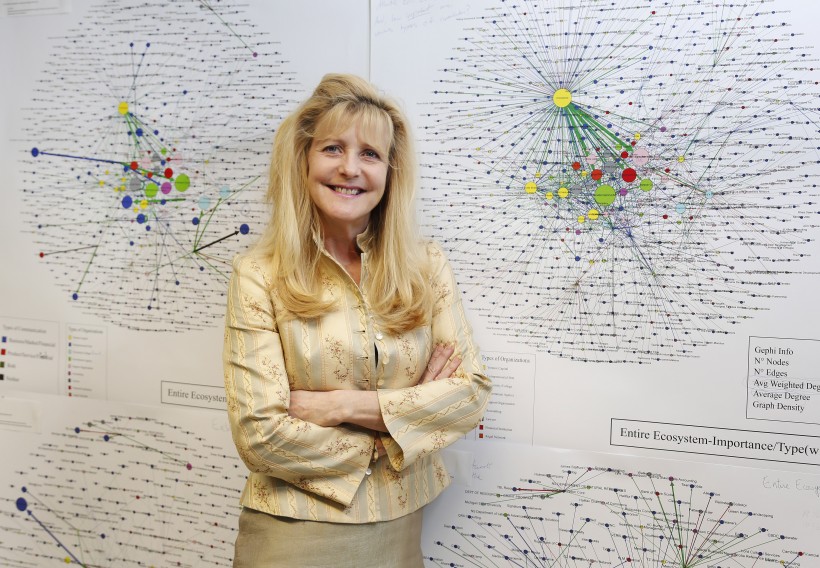

“The overall goal for the fund is to create an unparalleled educational experience for student entrepreneurs and students of finance to learn entrepreneurship from the inside-out,” said Ellen Farrell, Professor of Entrepreneurship and Venture Capital at SMU.

“This course and will be a differentiator for SMU, the Sobey School of Business and it will draw students to the Atlantic Region.”

With $47,000 now committed, Farrell said two different backers are now considering additional funding proposals worth a total of $100,000. The group made several funding proposals last week and are confident they will be able to raise the full $250,000.

UNB Launches Energia Accelerator

The team comprises three SMU alumni employed in in sales and entrepreneurship, six MBA students and four commerce students. The oversight board comprises: Farrell; Patrick Fitzgerald, a partner with Cox and Palmer; and Andrew Ray, a fund manager at Innovacorp. Venture Grade is working with a range of partners, including East Valley Ventures, Build Ventures and Relay Ventures.

Venture Grade will work alongside existing VCs, angel groups and investment bankers to identify investment opportunities. These more experienced funding bodies will invite Venture Grade to participate in funding rounds. The sectors and the geographic locations are determined by the investments of the partnering investment groups.

The overseers expect the early investments to be in seed and early stage companies, said Farrell, but the group hopes to extend its reach across the continent and make investments is Series A, B and C rounds. The students are conducting due diligence with four investments so far in conjunction with participating VC firms and hope that at least one will prove viable for a Venture Grade investment.

“Many people … think that the fund is students investing in students,” said Farrell. “It is, rather, students investing in viable venture-grade investments. They are being invited to participate by doing due diligence on the investments and writing investment memos that are scrutinized by the formal financiers.”

She added that another element of the project that is not readily apparent is that the students are being mentored by VCs and angels, both locally and as far afield as Silicon Valley. For example, they were to meet this week with Brenda Hogan, of the Ontario Capital Growth Corp., which oversees the province’s venture capital investments. They met with an investment banker and a VC from Silicon Valley last week.

She also stressed that the program is unique.

“I have found three other somewhat similar programs, except that in those cases, the students are not raising the fund,” said Farrell. “They were given the money to invest [and are not] being guided by the investment community.”